In 2017, the federal government proposed changes to its tax on split income (TOSI). Since then, due in part to opposition by farmers and farm groups, those changes evolved.

Now, after coming into effect for the 2018 tax year, financial advisers have more concrete knowledge of how TOSI actually applies.

Why it matters: Tax on split income rules officially changed in 2018, making it more difficult to divide farm-related income between family members.

According to Mike Veldhuizen, tax partner with MNP in St. Catharines, individuals are not paying less tax under the new rules. However, farm families may be more insulated from these changes than other businesses types.

How does TOSI work?

As of April 2, the federal government defines income-splitting (also called income sprinkling) as “a strategy that can be used by high-income owners of private corporations to divert their income to family members with lower personal tax rates.” Cases, that is, where individuals distribute their wealth in order to pay less income tax.

Under the current income tax rules, TOSI applies the highest marginal tax rate, which stands at 33 per cent, to the split income of an individual under the age of 18. In general, an individual’s split income includes taxable dividends, taxable capital gains, and income from partnerships or trusts. But as of Jan. 1, 2018, TOSI can also apply to income received by adult individuals from a related business.

Veldhuizen says these changes are designed to catch instances where spouses and adult children are receiving income despite not being involved in the business in question, a common example being cases where adult children are away at school, yet still receiving substantial farm-derived income.

Read Also

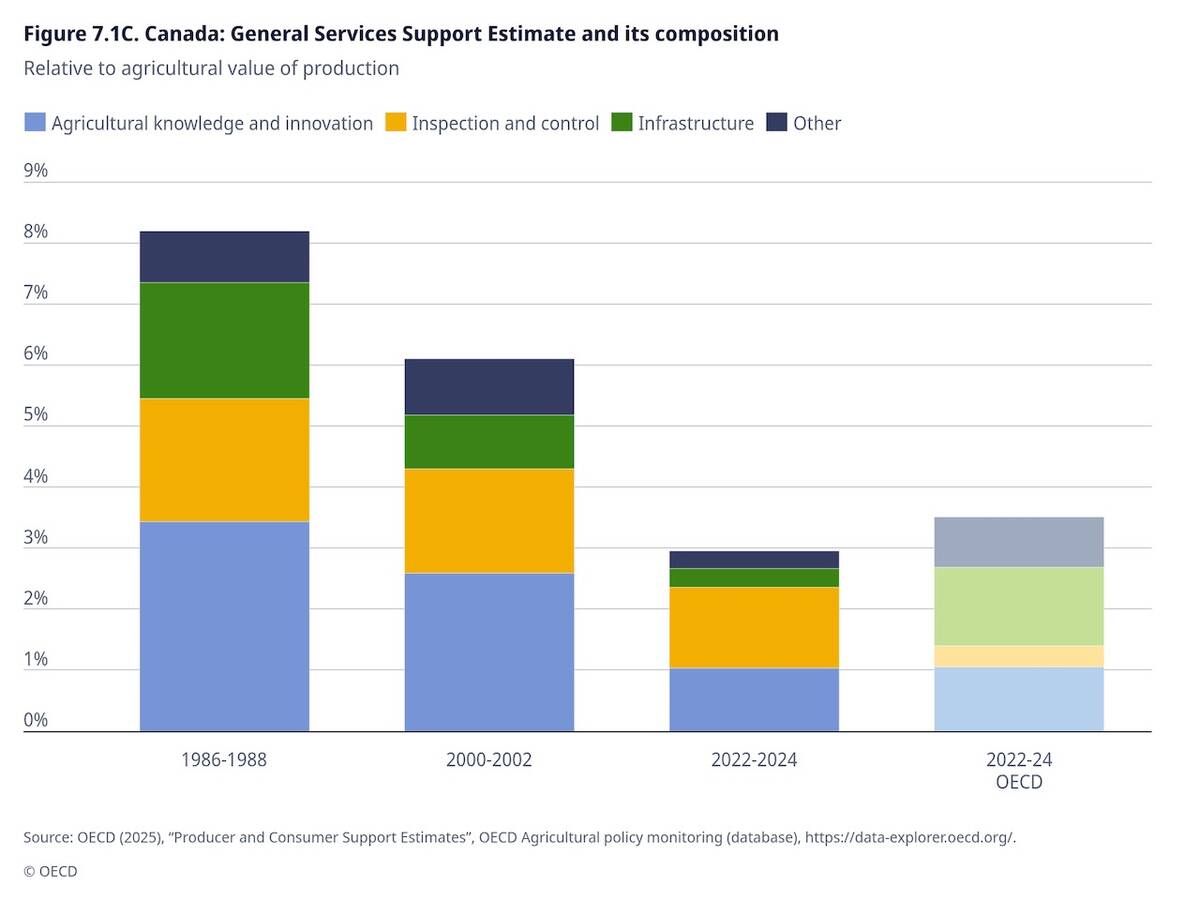

OECD lauds Canada’s low farm subsidies, criticizes supply management

The Organization for Economic Co-operation and Development lauded Canada’s low farm subsidies, criticized supply management in its global survey of farm support programs.

“The ability to split income with spouses is pretty much gone unless you’re over 65, or the spouse is active in the business,” says Veldhuizen.

Exceptions to TOSI

Family members involved in the farm for at least 20 hours each work week are exempted from TOSI. If this can be proven for five years in a row, Veldhuizen says, the exception applies permanently. But this does not apply for children ages 18 to 24 (the period during which said children are most likely to be away).

Family members are also exempt if they hold a minimum of 10 per cent of shares and value of the business. However, this only extends insofar as income from the business comes directly from farming. Service providers (custom operators, for example) do not fall into this category, thus TOSI would apply.

Veldhuizen also says income earned in a given company cannot be derived from business carried-on in a different company. If Company A, for instance, earns rent from Company B, but Company B operates the active business, then income in Company A wouldn’t meet the exemption criteria.

Documentation a necessity

Documenting work hours — and paying family members what they are worth for that work — is important when proving the validity of an exception, says Veldhuizen. He adds TOSI and its application is “very fact specific” to each individual business, and encourages farmers to talk with their tax advisers to see if TOSI does or does not apply.