You can tell every five to 10 years that the American milk situation is getting particularly dire, when they start having more discussions about supply management.

American dairy farms are in their fifth year of chronically low milk prices, which declined quickly in late 2014 from about $25 per hundredweight of milk to a range of $15 to $18 per hundredweight since.

That’s made dairy farming a pretty tough business for smaller farmers and indeed Wisconsin is losing about 30 dairy farms per month.

The situation has farm organizations, desperate to appear that they can find solutions for their dairy farmer members, pitching supply management as a solution.

Read Also

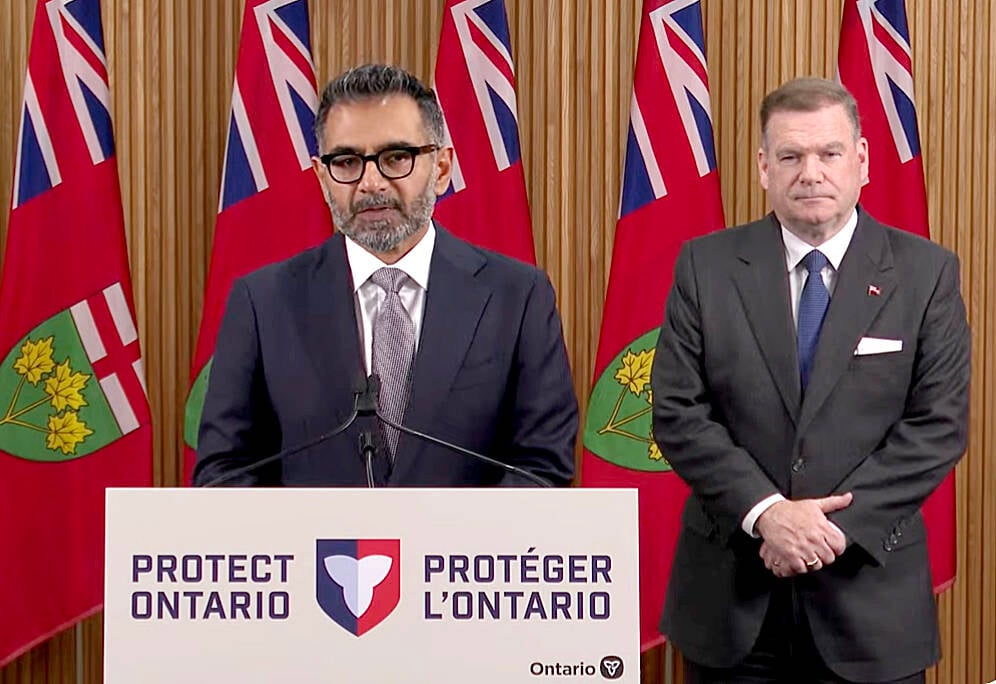

Conservation Authorities to be amalgamated

Ontario’s plan to amalgamate Conservation Authorities into large regional jurisdictions raises concerns that political influences will replace science-based decision-making, impacting flood management and community support.

Canadian dairy farmers, along with most poultry farmers, control supply of milk, chicken and eggs through their commodity boards (backed by legislation) and by the purchase of quota for certain levels of production by farmers. That has meant a more stable pricing system for those Canadian farmers. As more imports of new processed dairy products have entered Canada, farmers here have had to compete with lower-priced classes of milk, so the Canadian price of milk is now more influenced by world price than in the past.

It’s not just the American price that’s low. World price is also still stubbornly low.

I’ve seen this before. The last major downturn resulted in the Cooperatives Working Together (CWT) initiative, developed by the National Milk Producers Federation, in which most of the major dairy processor cooperatives in the United States, which process most of the milk, created a system, paid for by dairy farmers, that helped farmers reduce their milk production.

The organization is still around, but it obviously is having little impact on U.S. overproduction. It has become an organization that facilitates greater exports of milk around the world, which has somewhat helped the American industry, but also is contributing to the determined global glut in milk. In the past, before the U.S. became such a major export player, the world had to work through gluts in exported milk from New Zealand, Australia and Europe but not the U.S. That’s changed since the U.S. has increased its exports to 15.8 per cent of its production in 2018, according to the U.S. Dairy Export council.

I expected the U.S. debate on supply management to have died down again by now, but organizations such as the Wisconsin Farmers Union, National Farmers Organization and Holstein Association USA continue to push for a discussion on supply management. They are in the middle of a Dairy Together roadshow across the main U.S. dairy producing areas.

Canadian dairy farmers have their hand in some of it, with the last two chairs of the board of directors of Dairy Farmers of Ontario taking trips to the U.S. to talk about the Canadian system.

American organizations will continue to push the concept, but it will have little long-term traction beyond local meeting halls in farm country.

Managing an overburdened supply situation is not a short-term issue. I’ve been told over the years that a two per cent fluctuation in supply and demand in the U.S. will move milk prices from peak to valley. I was told at the World Dairy Expo last fall that the oversupply number is closer to four per cent in the U.S. not including the run up in milk exports of the past five to 10 years in the U.S. That’s going to take a lot of smaller (or larger) farmers going out of business to push that number to where prices will improve.

I don’t expect we’ll see supply management in the U.S. any time soon. The dairy business there, unlike hogs and poultry, hasn’t seen a large amount of consolidation. There are many thousands of smaller family farms making milk. I was also told that some believe that final consolidation is underway with this downturn. The smaller farms, without multiple locations and integration with processors, won’t survive this time. I don’t believe it’s going to go that far, but at the 2018 World Dairy Expo, there was a definite vibe of inevitability of change in the market.

It’s like a tale of two cities: larger producers, tied to exporting processors, will not want supply management. Smaller farmers will. As we know well here, the rest of the world gets grumpy when a country managing supply also tries to export.

It wasn’t that long ago that the U.S. mostly only served its own market. Now it exports almost 16 per cent of its record production, the largest in the world. That’s a lot of milk production to reduce, and, despite the challenges posed by lower milk prices, larger U.S. dairy farms I’ve talked to over the past couple of years see their future lies in filling export markets.