Glacier FarmMedia – A senior official at Maple Leaf Foods says Canadian policies, programs and regulations are hurting economic growth and competitiveness.

Rory McAlpine, senior vice-president, government and industry relations, made the remarks during a speech at the Canadian Agricultural Economics Society policy summit held in Ottawa from Jan. 23 to 24.

Why it matters: Governments have to strike a balance — using regulations to protect consumers and workers, while not over-regulating to the point of discouraging businesses and harming economic growth.

Read Also

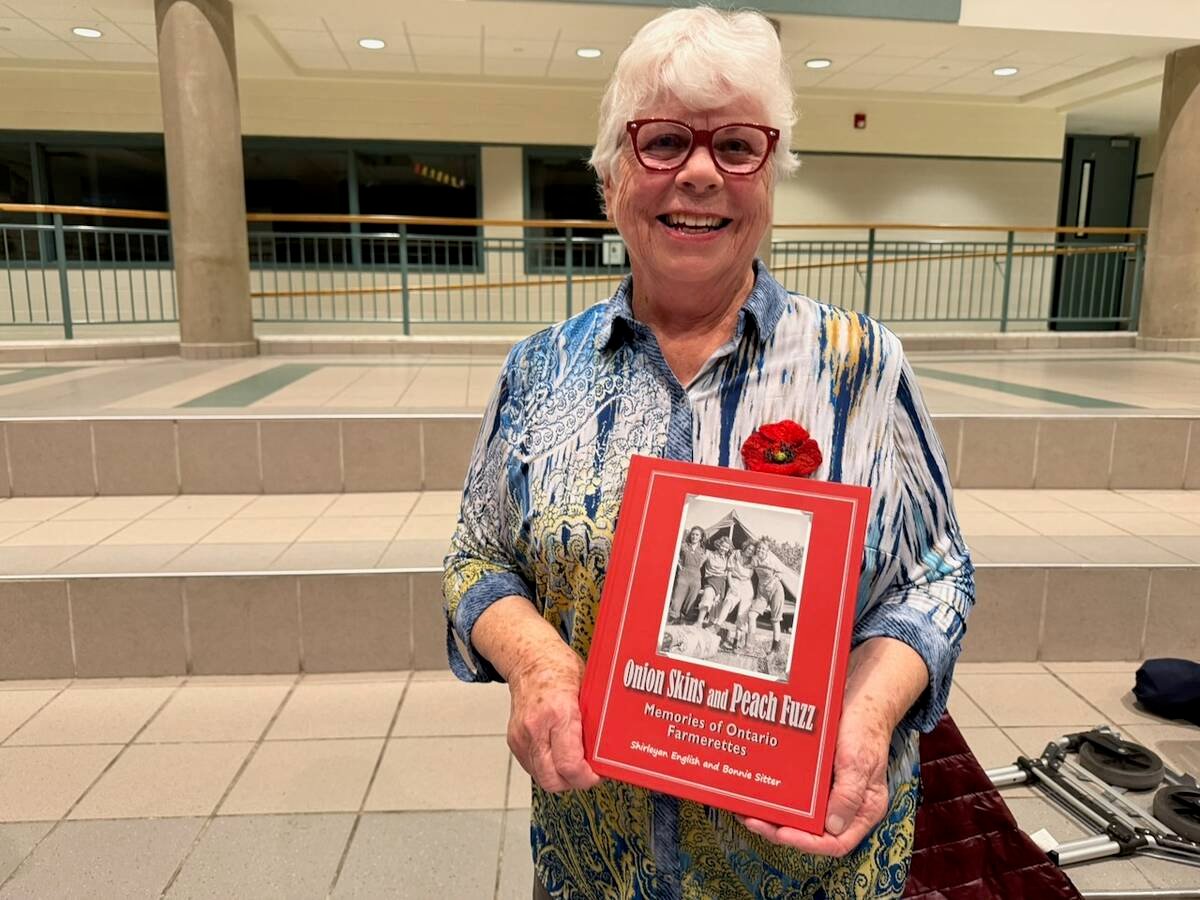

Women who fed a nation

More than 40,000 young women supported the war effort between the 1940s and early 1950s, helping grow and harvest crops amid labour shortages. They were called Farmerettes.

McAlpine said investments iin technology for manufacturing or packaging, such as those being made as part of the company’s chicken processing facility being built in London, Ont., are costly and require, “global scale operations and market share to achieve the revenues and manage the expense.”

He suggested doing so is “simply more challenging” due to Canada’s size, small population, construction costs and a “history of economic policies and provincial attitudes that serve to limit or equalize scale, thus constraining labour productivity and competitiveness.”

McAlpine told the audience the regulatory environment in Canada is “grossly uncompetitive,” noting uncompetitive labour laws, payroll taxes in certain provinces, utility costs, infrastructure bottlenecks and complex municipal zoning and permitting processes all contribute to an impaired performance of value-added packaged goods manufacturers.

“Higher environmental requirements and now carbon pricing,” were also mentioned.

Maple Leaf Foods Inc. is spending a combined $1 billion on its London facility and a plant-based foods facility in Shelbyville, Indiana; allowing the company to offer a perspective on the regulatory environment in Canada compared to the United States.

To that end, McAlpine noted construction costs are 20 to 25 per cent higher in Canada due to factors such as land costs, labour rates, climate-related building standards and market concentration in the supply of key building materials like cement and steel.

He said U.S. jurisdictions are “more than willing to open their subsidy and tax wallets for large capital projects” while in Canada, governments are strongly biased in favour of foreign companies and dazzling, disruptive innovation instead of investment by Canadian companies in scale plants and applied technologies.

McAlpine said addressing this is the first priority for food manufacturers and, if not addressed, companies will go south of the border “with the help of very generous state subsidies.”

The Shelbyville plant is being supported by nearly US$50 million in government and utility incentives, including $9.6 million for start-up costs and US$40 million in operational support over the next decade.

Maple Leaf’s London-based plant is receiving roughly US$40 million in support from the Ontario and federal governments.

McAlpine concluded his remarks by taking aim at Health Canada, saying it needs to, “stop treating the food industry like the enemy of healthy eating and work with us to tackle the problem of poor dietary choices.”