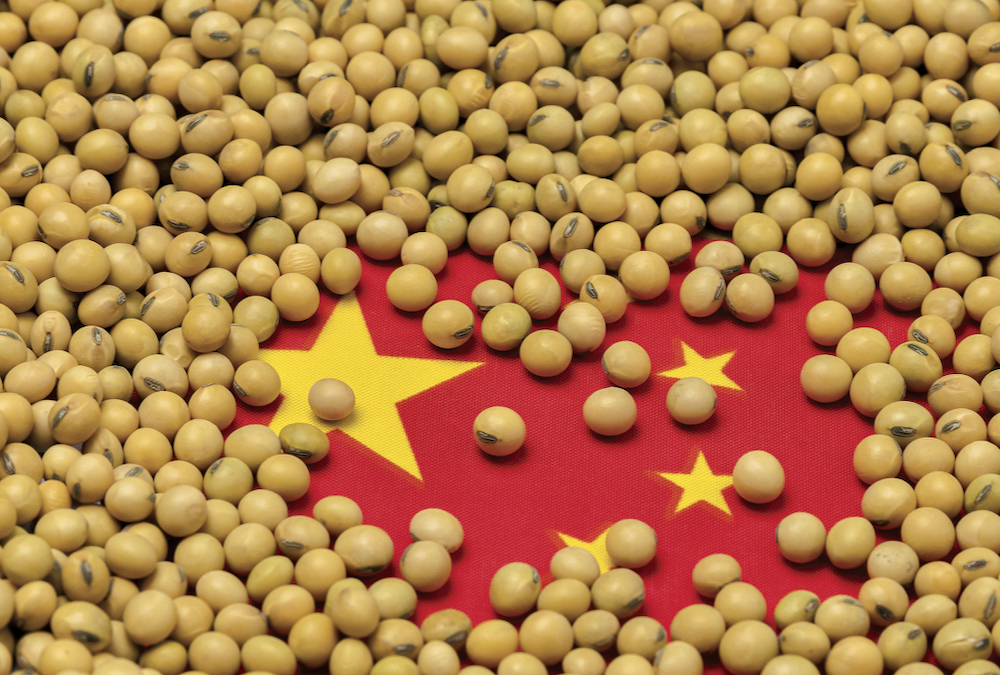

Reuters – China’s soybean imports in the first two months of 2022 rose from the previous year, beating market expectations, according to March 7 customs data.

China, the world’s top importer of soybeans, brought in 13.94 million tonnes of the oilseed in the Jan.-Feb. period, up 4.1 per cent from 13.41 million tonnes in the same period in the previous year, data from the General Administration of Customs showed.

The market had expected smaller arrivals after adverse weather in Brazil, the top supplier of soybeans to China, delayed harvesting and cut estimates for the new crop.

Read Also

Canada seventh-most influential country on agri-food

Report from Dalhousie University and MNP shows Canada ranks seventh among G20 countries on agri-food influence.

Trade flows according to Refinitiv data, however, only showed 7.8 million tonnes of China soybean imports in January and 4.4 million tonnes in February, which totals 12.2 million tonnes of imports for the two months.

“Imports in the first months of 2022 were larger than we expected. Based on our data, the arrivals were not this high. Otherwise there wouldn’t be such tightness in the domestic market,” said Zou Honglin, analyst with the agriculture section of Mysteel, a China-based consultancy.

Zou said the discrepancy in data could be due to non-commercial cargoes among the arrivals. “The commercial buying did not support such high figures,” Zou said.

China does not break out separate import figures for the first two months of the year due to the impact of the Lunar New Year holiday.

Drought and excessive rains in some regions in top producer and exporter Brazil have slashed estimates for the new crop there, as well as delaying harvests and loading at ports.

Smaller than expected soybean arrivals have forced some major crushing plants in China to suspend operations, sending soymeal prices higher.

Importers have turned to beans from the United States in recent weeks after American shipments became competitive against Brazilian cargoes, with Brazil prices soaring on supply worries.

Chinese crushers bring in soybeans to crush into soybean meal to feed the massive livestock sector and for cooking oil.

Soybean arrivals in March and April are expected to remain limited, as bad weather continues to affect crops and shipments from Brazil.

Soymeal prices in China have also been driven higher by Russia’s invasion of Ukraine, which has severely disrupted the global agricultural supply chain.