Reuters – JBS SA, the world’s largest meatpacker, is bullish on the outlook for beef sales to Asian countries, mainly China, as per-capita beef consumption in the region remains low.

Speaking on a conference call to discuss second-quarter results, CEO Gilberto Tomazoni said JBS, with its many export platforms, was in a good position to cater to that demand.

“The rise in beef imports is structural in Asia given the improvement in (consumers’) purchasing power,” Tomazoni said.

Read Also

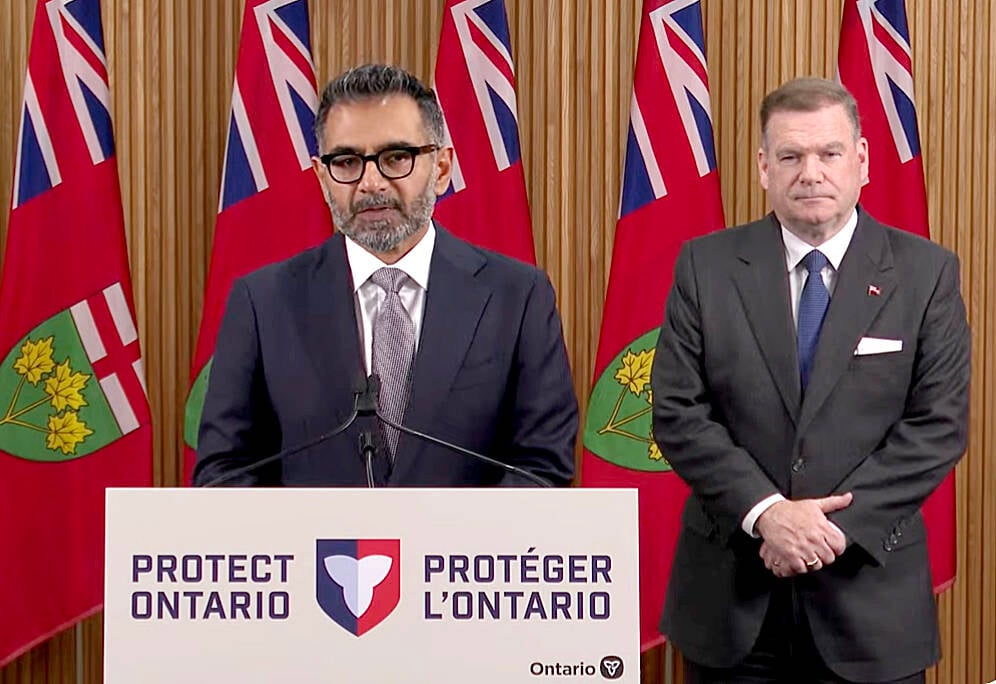

Conservation Authorities to be amalgamated

Ontario’s plan to amalgamate Conservation Authorities into large regional jurisdictions raises concerns that political influences will replace science-based decision-making, impacting flood management and community support.

JBS exports beef from plants in Brazil, Australia, the U.S. and Canada. The company also processes pork, chicken and fish products in multiple countries.

JBS reported a reduction in net profit, citing relative weakness of its U.S. beef and pork businesses.

“The fall of margins in U.S. beef operations was almost entirely compensated by the other business units,” Tomazoni said.

JBS reported net revenue almost eight per cent higher for the last quarter, while overall operating margins remained in the double digits.

U.S. beef operations were partly affected by a lack of animal supply for processing, though beef exports from the U.S. are expected to be a record this year, Tomazoni said.

Pork sales, on the other hand, are expected to reflect lower demand from China, where hog herds are growing again after an outbreak of African swine fever in 2018.

In Brazil, JBS’ Seara division was able to increase prepared food products prices, boosting profitability.

“Seara surprised even the most upbeat,” Credit Suisse said in a note to clients. Seara’s 14.1 per cent operating margin was a record, analysts said.

JBS executives said Seara’s price increases helped offset cost inflation, but also reflected a better product mix of sales.