Timely rain over the past couple weeks across Ontario has sustained yield potential. However, the Bruce, Grey and Niagara counties only received about 25 mm or less during this time and yields may be lower in these areas.

Steady Chinese demand for Ontario soybeans has supported local basis levels. The Ontario winter wheat harvest was 75 per cent complete as of Aug. 1 and yields will be in line with the five-year average. A portion of the winter wheat will be downgraded due to the recent precipitation. U.S. corn and soybean yield estimates have been trimmed from our earlier expectations due to extreme temperatures in the U.S. Midwest.

Read Also

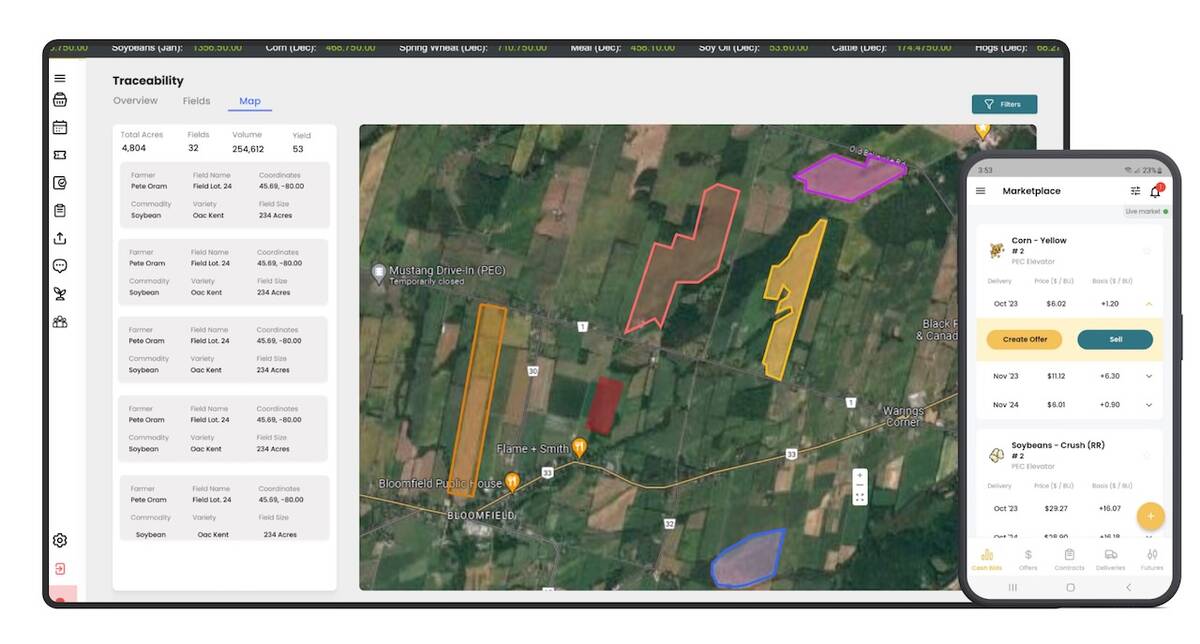

Ontario company Grain Discovery acquired by DTN

Grain Discovery, an Ontario comapny that creates software for the grain value chain, has been acquired by DTN.

World corn stocks will drop to 10-year lows at the end of the 2018/19 crop year, therefore, the corn market is sensitive to changes in U.S. yield potential. The wheat market is incorporating a risk premium due to production uncertainty in Russia, the European Union and in Australia. Lower production prospects in the U.S. and Canadian spring wheat crops are also underpinning the wheat complex. Bloomberg news service recently reported that U.S. Treasury Secretary Mnuchin was speaking with Chinese Vice Premier Liu to reopen trade talks.

Quick look:

- Soybeans: Chinese buying is supporting Ontario soybean basis prices.

- Corn: U.S. corn production likely to come in higher than USDA predictions.

- Wheat: Variable weather – drought in parts of Europe and excess rain in Russian mean harvest unknowns.

Soybeans

Ontario cash soybean prices are up about $0.40/bushel since mid July. The U.S. soybean crop was rated 70 per cent good to excellent as of July 29, which is similar to a month earlier; however, above normal temperatures have curbed yield expectations across the Midwest. It’s important to realize that if conditions are not improving, the market will trade sideways to higher. U.S. soybean production is expected to reach 119 to 121 million tonnes, which is down from our mid July estimate of 126 million tonnes but still up from the recent USDA projection of 117 million tonnes. The 2017 crop size was 119 million tonnes.

The soybean complex has experienced one month of Chinese tariffs. Export basis levels for Brazilian soybeans are hovering around US$1.85 over the September futures; ocean freight from Brazil to China is about US$38/tonnes. U.S. beans f.o.b. the Gulf are offered at 0.35/bushel over the September futures and ocean freight to China is quoted at US$50/tonnes. U.S. soybean prices do not have to factor in the 25 per cent Chinese tariff. Export prices f.o.b. the Gulf only have to trade at levels so that U.S. soybeans can trade into Brazil. It appears the basis is adjusting for the tariff while the futures market is factoring in the world fundamentals. Talk in the industry is that U.S. soybeans are now trading to other destinations which has also been supportive to the futures market.

Logistical issues continue to temper Brazil’s export potential. Soybean handling margins in Brazil are down to bare bone levels because of the difficulty moving soybeans into export position. Chinese demand has also been rather slow due to the build up of U.S. stocks prior to the tariffs coming into effect. There have been a few cargoes of Ontario soybeans trade into China. Current values in the elevator system and ocean freight make Ontario soybeans very competitive with Brazilian origin. Ontario soybean production is expected to finish near 3.9 million tonnes, up from the 2017 crop of 3.8 million tonnes and above the five-year average output of 3.6 million tonnes.

What to do: Earlier in May, we advised producers to sell 25 per cent to 30 per cent of their expected 2018 production. Ontario soybean exports are expected to be marginally higher than last year. Basis levels in the Ontario are expected to strengthen later fall and early winter once Chinese soybean stocks decline. We believe it will take at least six to eight months for the U.S. and China to settle their trade concerns.

Corn

The U.S. corn crop was rated 72 per cent good to excellent as of July 29 and 91 per cent of the crop is silking. Traders have been somewhat skeptical of the crop ratings. Certain regions of the U.S. Midwest received extensive rains during June but precipitation throughout July was limited. Secondly, the extreme temperatures may have hindered the pollination process in some areas. Last month, we were estimating the U.S. corn crop to finish in the range of 368 to as high as 370 million tonnes. We are now forecasting U.S. corn production to come in around 363 million tonnes which is still higher than the USDA projection of 361 million tonnes but down from 371 million tonnes last year.

World corn ending stocks for 2018/19 are estimated at 150 million tonnes, which is down from the 2017/18 carryout of 192 million tonnes and also below the 10-year average of 164 million tonnes. European production estimates have been lowered due to drier conditions in the main regions. In Brazil, the Safrinha second crop corn is about 55 per cent harvested and yields are in line with expectations. The Ukraine corn crop is in decent shape and production is estimated at 30 million tonnes, up from 24 million tonnes last year. Given the tighter world stocks, the corn market is extremely sensitive to U.S. yield projections. Keep in mind the corn futures tend to make a seasonal low in late August or early September prior to the main U.S. harvest.

The recent rains and moderate temperatures were optimal for Ontario corn pollination. Therefore, we have not changed our production estimate from last month. A couple areas were on the dry side but Ontario corn crop is expected to finish near 8.1 million tonnes, which is slightly lower than the 2017 output of 8.7 million tonnes.

Ontario old crop corn prices were in the range of $4.40/bushel to $4.50/bushel in late June. Elevator bids are now in the range of $4.80/bushel to $4.90/bushel. Ontario prices are actually higher despite the lower futures market. This reflects the tightness of old crop stocks. New crop corn prices are trading at equivalent levels to old crop. The cash market is telling farmers not to store old crop corn into new crop positions.

What to do: For new crop, we earlier advised producers that selling 15 per cent to 20 per cent of expected production but not to be overly aggressive. The lower world ending stocks will result in a year-over-year increase in export demand for Ontario and U.S. corn. We are expecting the corn market to percolate higher throughout the fall and winter. The world is now in a situation where the market cannot afford a crop problem in South America or prices could make another leg higher. We could see the corn futures incorporate a significant risk premium over the winter until the South American crop is more certain. Argentinean and Brazilian corn acres are expected to be down from last year given the higher returns per acre for soybeans.

Wheat

The Ontario winter wheat harvest was 50 per cent complete as of July 18. Since then, farmers have combined about 25 per cent bringing total progress to 75 per cent. Approximately 25 per cent of the crop is still in the field. Quality and yield results were quite favourable for the first half of the crop. Quality is quite variable on wheat that was harvested over the past two weeks. We are hearing reports of some blackpoint and sprouting. Testweights are also slipping which is to be expected. We don’t advise new crop sales on wheat until farmers are comfortable with their quality parameters. The recent rains have been favorable for spring wheat but fusarium is a concern in some pockets.

The industry led U.S. spring wheat crop tour was discouraging. Yields were above last year but below the five-year average. It is important to realize that with the year-over-year increase in seeded acreage, the U.S. hard red spring crop will finish near 14.4 million tonnes, up from the 2017 crop size of 10.5 million tonnes and slightly higher than the five-year average output of 14.2 million tonnes.

All three wheat futures markets have experienced a significant rally over the past two weeks. The U.S. winter wheat harvest is in the final stages and yield estimates are unchanged from last month. Across the pond, crop potential has deteriorated from earlier projections. Germany, the northern half of Poland and the UK have received less than 50 per cent of normal precipitation over the past two months. Some regions in France are in a very similar situation. The EU crop could be down 12 to as much as 18 million tonnes from last year on the upcoming USDA report. The European wheat harvest is about 85 per cent complete.

In Russia, much of the Southern and Volga districts received less that 25 per cent of normal precipitation from June 1 through July 15. In the latter half of July, rains plagued much of the winter wheat region in Russia which has downgraded quality. The Russian winter wheat harvest is about 45 per cent complete. Russia could experience a year-over-year decline in production of 15 to 20 million tonnes.

August will be a critical month for Australia. Western Australia and Victoria have received about 10 to 25 mm of rain over the past week. Some pockets in Western Australia received 25 to 50 mm of rain but this has done little to alleviate drought concerns. If we don’t see timely rains in August, yield damage will be irreparable.

In Ontario, the winter wheat crop is expected to finish around 2.1 million tonnes, down from the 2017 crop of 2.2 million tonnes. For soft red winter wheat, the function of the milling quality market is to ration demand away from export channels. Therefore, look for stronger basis levels over the winter. We’re estimating the Ontario spring wheat crop at 110,000 tonnes down from the 2017 production of 114,000 tonnes.

What to do: We’ve advised producers to finish up old crop sales and we’ll be patient to make our first sales recommendation for new crop. The markets are in the process of adjusting to final production estimates for the Northern Hemisphere wheat crops. Basis appreciation is expected for Ontario milling quality soft red winter wheat.