The opening of a new agriculture office in the Indo-Pacific region is being welcomed as a potential new model that could help companies sell more agriculture products there.

The federal government recently announced its new Indo-Pacific strategy which encourages greater Canadian involvement in the area, which is expected to be home to two-thirds of the middle-class consumers on the planet by 2030.

Marie-Claude Bibeau, Federal Minister of Agriculture and Agri-Food met Jan. 30 with 22 agriculture industry associations to discuss the $31.8 million investment in the new office in the region.

Read Also

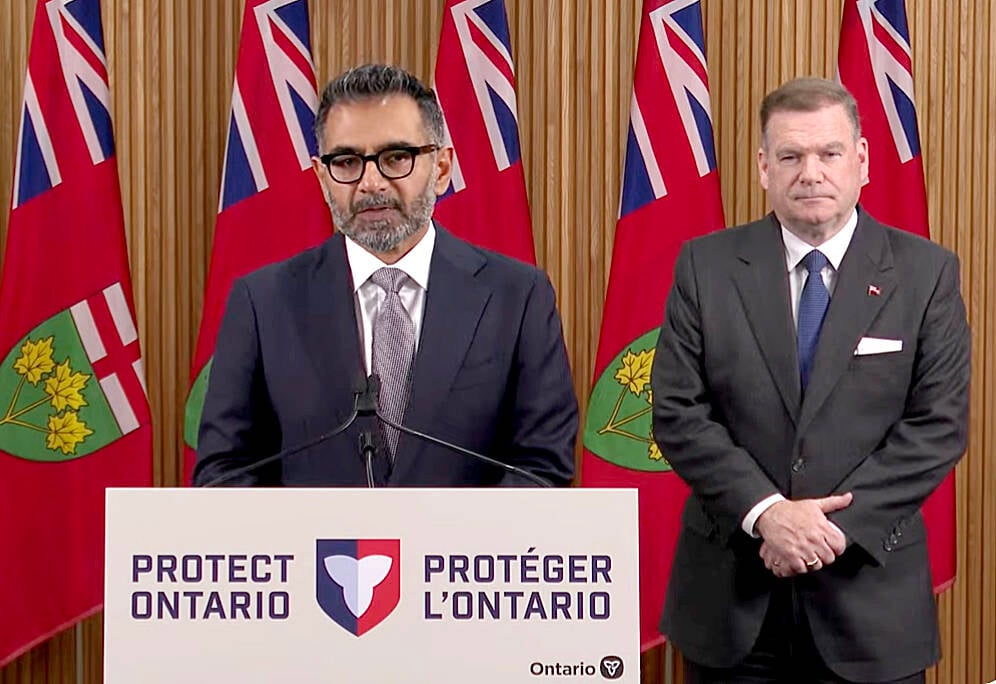

Conservation Authorities to be amalgamated

Ontario’s plan to amalgamate Conservation Authorities into large regional jurisdictions raises concerns that political influences will replace science-based decision-making, impacting flood management and community support.

Why it matters: Growing reliable trade to a region adding population and affluence, like the Indo-Pacific region, can help create opportunities for farmers.

“Having people on the ground is important,” says Kevin Sears, president and CEO of the Canadian Pork Council.

“If in-market relationships exist it can just be a phone call to solve an issue. Otherwise, a situation can spin out of control and cause problems.”

Having a Canadian Food Inspection Agency person in the region will help if a seal has been broken on a load when it arrives, he says.

Sears was on a panel at a recent conference in Ottawa put on by the Canadian Agri-Food Policy Institute, the Canadian Agri-Food Trade Alliance and the Canadian Global Affairs Institute.

The Indo-Pacific region comprises 40 countries, including major markets like China, India and Japan.

The federal government released a long-awaited Indo-Pacific strategy last year and it outlines how it will approach the region – fast growing in population, in wealth and increasingly critical in trade and politics.

China was the major focus of reporting on the announcement, but other countries are of interest.

The area is the major destination for pulses, the high-protein crops mostly produced in Western Canada and half of Canadian pork exports end up in the Indo-Pacific region.

Kevin Auch, an Alberta farmer and chair of Pulse Canada, says that 35 per cent of Canadian pulse exports go to China, 11.5 per cent to India and 9.5 per cent to Bangladesh.

Auch says that Canada can’t compete as the lowest-cost producer of products like pulses, but with a large and growing middle class in that region, there are significant markets where Canada can tell its story and do well.

For example, he talked about how a group of foreign buyers visited his farm and while on their way to look at an irrigation system, he stopped at his bins and showed them some chickpeas.

They asked all sorts of questions about fumigation and storage problems, none of which Auch had to worry about because of the initial quality of the product and cooler Canadian temperatures.

“We have a quality advantage,” he says.

Canada trading in that region of the world isn’t new. Sears pointed out that Japan opened to Canadian hog exports in 1968.

“We talk about it as if it is something new, but we have been trading there for a long time,” says Jean-Marc Rivest, senior vice-president, Corporate Affairs and General Counsel, with Richardson International.

Having a strategy is a start, but without challenges and barriers addressed, success isn’t likely.

“The tendency is for trade policy to take an overly simplistic view of the sector,” he says.

When a vessel is loaded with $35 to $50 million worth of crops, and the margins on the load is slim, risks have to be manageable, he says.

A phytosanitary issue is a good excuse to avoid paying a contract that is higher priced by the time the load arrives, especially in China.

There are some areas in the Indo-Pacific where they just don’t do business, says Rivest, as the risks can’t be overcome.

Canada has also had more internal risks to trade, including blockages and rail line service interruptions, all while infrastructure is deteriorating.

There’s some optimism that arbitrary trade barriers won’t be as much of an issue at a time when countries really need the shipments of food.

“Countries made a big deal in the past about glyphosate residues aren’t saying much now,” says Rivest.