The surge of counterfeit honey into global honey supplies has been devastating for Canadian beekeepers.

“It’s been twisting my hand because I can’t stay here,” said Tim Wendell of Wendell Honey in Saskatchewan.

“I don’t know if the price is coming back or how long it’s going to take. It always has come back, but is it even going to happen this time because no one seems to care.”

Why it matters: Canadian honey producers are being forced to accept lower prices because of unfair competition from unscrupulous honey sellers.

Read Also

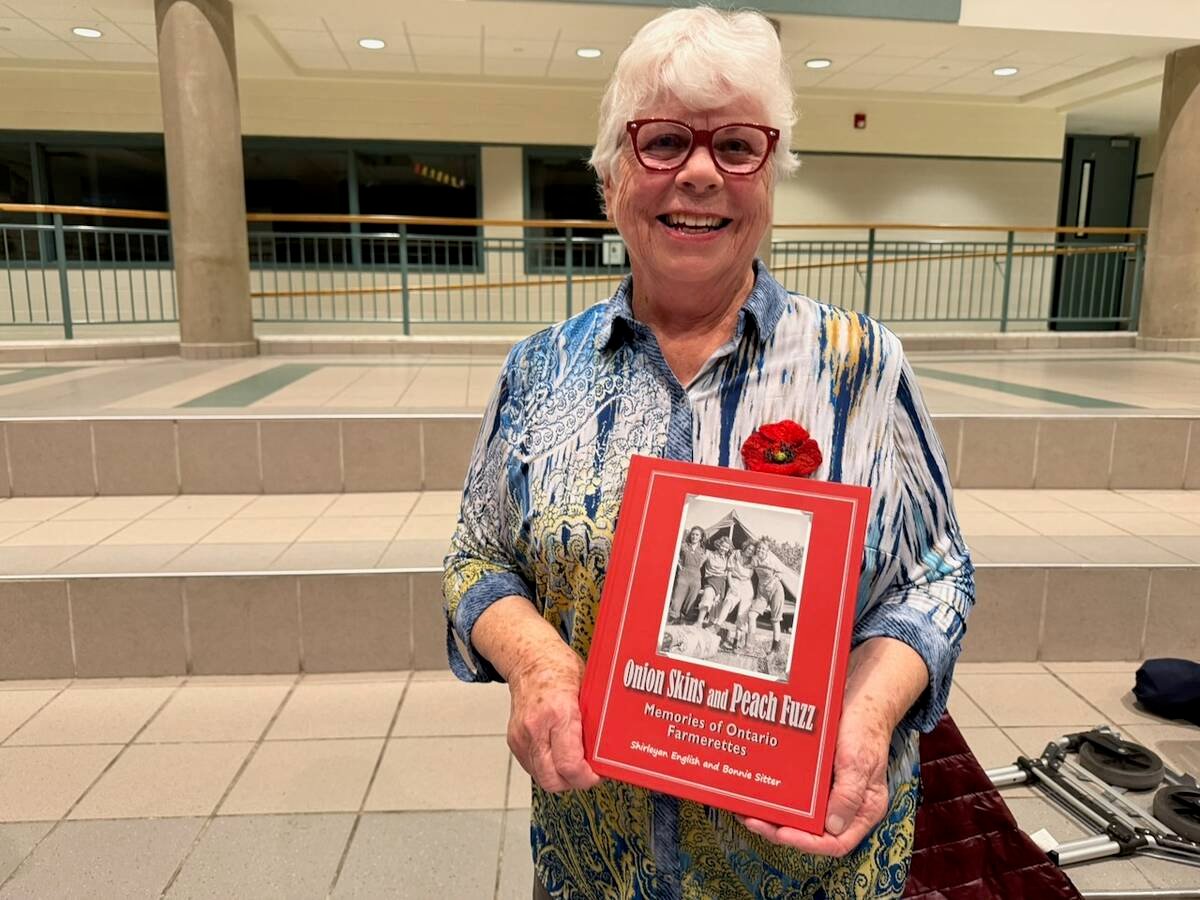

Women who fed a nation

More than 40,000 young women supported the war effort between the 1940s and early 1950s, helping grow and harvest crops amid labour shortages. They were called Farmerettes.

Wendell has been in the business a long time. He and his wife, Isabel, officially took over the hives from his father in 1974, but bees have always been part of his life.

Recently, from 2010-12, the price for a pound of honey surged to more than $2 in Canada, and honey producers enjoyed healthy profits.

But the boom was short-lived as fraudulent honey flowed into world honey markets.

The extra volume of honey on the world market quickly weighed on prices, which fell to as low as $1.10 per lb., well below the cost of production for Canadian producers.

Today bulk honey returns are showing some strength and it is possible for honey producers to reap a small profit. However, the problem of fraudulent honey persists, and how long the price will stay at this level is anyone’s guess.

“(Adulterated honey is) a worldwide problem. What it has done is it’s basically downgraded the price of Canadian honey, of basically all honeys,” said Rod Scarlett, executive director of the Canadian Honey Council.

“They will take honey and they will add corn syrup, rice syrup, or another sweetener to add more bulk. They will sell it as honey, and the corn syrup and rice syrup is very cheap. So they adulterate the product to get more product to sell at a higher price.”

Honey consistently ranks among the top adulterated agricultural products, and a study published this October in Nature, titled Authenticity and Geographic Origin of Global Honeys Determined Using Carbon Isotope Ratios and Trace Elements, set out to test world honey supplies.

It confirmed the practice of adulterating honey is common and widespread.

“We found that 52 per cent of Asian honey samples tested were adulterated (11 of 21 samples), of which three were from China (3/7), one from South Korea (1/1), one from India (1/2), two from Indonesia (2/2) and four from Iran (4/4),” the study said in its discussion section.

“Six honey samples from Europe, from a total of 21 tested, contained added sugar. These honeys originated from Macedonia (2/3), Romania (1/2), Serbia (1/1), Greece (1/5) and Hungary (1/3). Australia has a lower adulteration rate (18.4 per cent in total).”

Canadian honey is considered among the safest in the world, largely because the industry has to follow strict rules set out by the Canadian Food Inspection Agency. However, this reality doesn’t seem to matter to American processors, which treat Canadian honey the same as honey from areas where adulteration is a known problem.

The U.S. is the world’s top consumer of honey, but there is a large price spread between what’s paid for honey produced in the U.S. and imported honey, partially because of concerns over adulterated honey.

“We receive at least a dollar less than American producers per pound, yet our biosecurity and food safety standards certainly exceed theirs, and everybody that exports to the U.S. can be examined by the (U.S. Department of Agriculture),” Scarlett said.

With the use of anti-dumping laws, the U.S. no longer imports honey from China, where much of the adulterated honey is suspected to originate.

However, Chinese honey still makes it into the U.S. through trans-shipments.

Canada produces much more honey than it consumes, but imported adulterated honey has been found in Canadian stores.

Before April 1, 2017, the CFIA tested between 64 and 100 samples of imported honey a year for the presence of foreign sugars and found three to nine samples that contained added sugar.

Starting in April 2017, the agency increased the amount of honey it tested and collected 186 samples of imported honey in 2017, 11 of which were found to be adulterated.

Thus far in 2018, the CFIA has tested 299 samples of imported honey, and 24 had foreign sugars.

The CFIA currently tests only for C-4 sugars (sugars from cane or corn syrups) in honey, but it is investigating the use of nuclear magnetic resonance spectroscopy (NMR) to identify other sugars that may be used to adulterate honey.

In 2017 Canadian honey production was worth approximately $188 million: $79 million was exported, while imports of honey into the country were worth $41million.

Scarlett said the value of imported honey is largely made up of high value organic honey and manuka honey from Australia and New Zealand.

There are two major end uses of honey: pure honey sold on store shelves directly to consumers and the baking and processing market.

The adulterated honey is primarily sold in barrels to the processing market.

Wendell Honey is a good example of how Canadian honey producers are adapting.

The volatility of the bulk honey price has always made Wendell’s business vulnerable.

In 2011, during the last price up-swing, the company increased the amount of honey it bottled and started to develop its own brand because the price it receives for packaged honey is much more stable than bulk sales, and they have more control over the packaged honey price.