At a recent Toronto conference for agri-tech companies and corporate venture capitalists, keynote speaker Alison Rabschnuk – veteran marketer and director of corporate engagement for American investment nonprofit The Good Food Institute – delved into the opportunities in plant-based alternatives to animal protein.

Why it matters: Bleeding bean burgers and other veggie takes on animal-protein staples have been making headlines for some time, and for good reason. The people and businesses interested in getting quality plant-based meat alternatives to the market at competitive prices are both diverse and global in scope.

Read Also

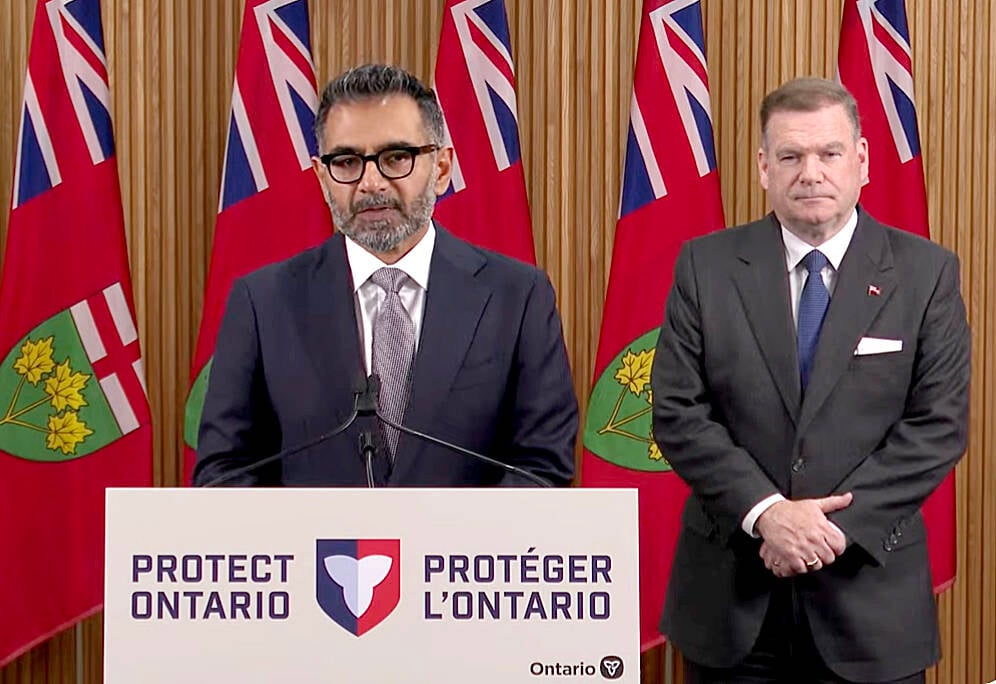

Conservation Authorities to be amalgamated

Ontario’s plan to amalgamate Conservation Authorities into large regional jurisdictions raises concerns that political influences will replace science-based decision-making, impacting flood management and community support.

Considering The Good Food Institute’s mandate to espouse the value of “clean meat,” however, it’s perhaps not surprising that Rabschnuk’s presentation was based partially on regularly heard opposition to meat.

Clean meat is big business

Indeed, so profound are the perceived opportunities in plant-based meat substitutes that traditional animal-protein companies – such as the colossi of Cargill and Tyson – have already made significant investments. Enthusiastic support from business celebrities like Bill Gates and Sir Richard Branson, not to mention some notable Hollywood denizens, certainly don’t detract from the enthusiasm.

As marketers of such products Rabschnuk and other supporters of clean meat investments are quick to point such things out. Her presentation emphasized the amount of money already invested in clean meat technology, and detailed an optimistic view of the growing marketability of such products – both in terms of rapidly increasing product quality and diversity, as well as ever-growing demand from younger demographics (namely millennials).

Rabschnuk said her investment organization has identified 21 overarching “commercialization opportunities” where food start-ups and corporate investors have particularly acute potential to generate novel products and access those ever-growing markets. This includes, for example, the removal of undesirable flavours commonly present in animal-protein substitutes, and the development of more diverse plant-based fats.

Such products also make for interesting food science that could support new and diverse markets for agricultural commodities. And that says nothing of the increased choice they offer those adhering to vegetarian or vegan lifestyles, not to mention individuals just looking for something a little different.

“We want plant products to have the same standing on the shelf as meat products. There’s plenty of room to grow,” she says.

Perpetuating the clean meat halo effect

In espousing the merits of plant-based meat, dairy, and egg alternatives, Rabschnuk – not unexpectedly – used environmental sustainability as a selling point. More specifically, she cited “Livestock’s long shadow” – a 2006 report published by the Food and Agriculture Organization (FAO) of the United Nations – as a critical driver behind the clean meat movement.

Indeed, in the 12 years since its publication, “Livestock’s long shadow” has become well-known for its assertion that greenhouse gas emissions and other environmental hazards of livestock production pose a greater threat to the global climate than the daily burning of fossil fuels. Needless to say, the report was quickly adopted by special interest groups to promote their own worldview.

Since it was published, however, problems have been identified with the report’s merits.

The report itself is outdated. The FAO published another report in 2013 after criticisms on the methodology used to reach its 2006 greenhouse gas-related conclusions. The 2013 report assessed the global greenhouse gas contribution of livestock at 14.5 percent of all anthropogenic GHG emissions, less than the 2006 report.

Other concerns included not addressing regional variances in livestock production – clear-cutting rainforest to rear cattle is one thing, after all, while grazing sheep on well-managed pastureland is another. The FAO also doesn’t call for an end to animal agriculture, something not mentioned by those who use the report to argue for an end to animal use.

Regardless, the interest and opportunities in developing, producing, and investing in animal-protein alternatives are significant, and investors are taking notice.