Glacier FarmMedia – Brexit might amount to a hill of beans.

Navy, or white beans, to be precise.

“If we see a no-deal Brexit, what does that do to the trade routes for navy beans?” said Cindy Brown, the president of the Global Pulse Confederation, during the Pulse and Special Crops Convention.

“Will we see disruption in supply? Will we see different pricing?”

Why does Brexit provide an exceptional challenge to navy bean markets, as opposed to the many other types of bean?

Read Also

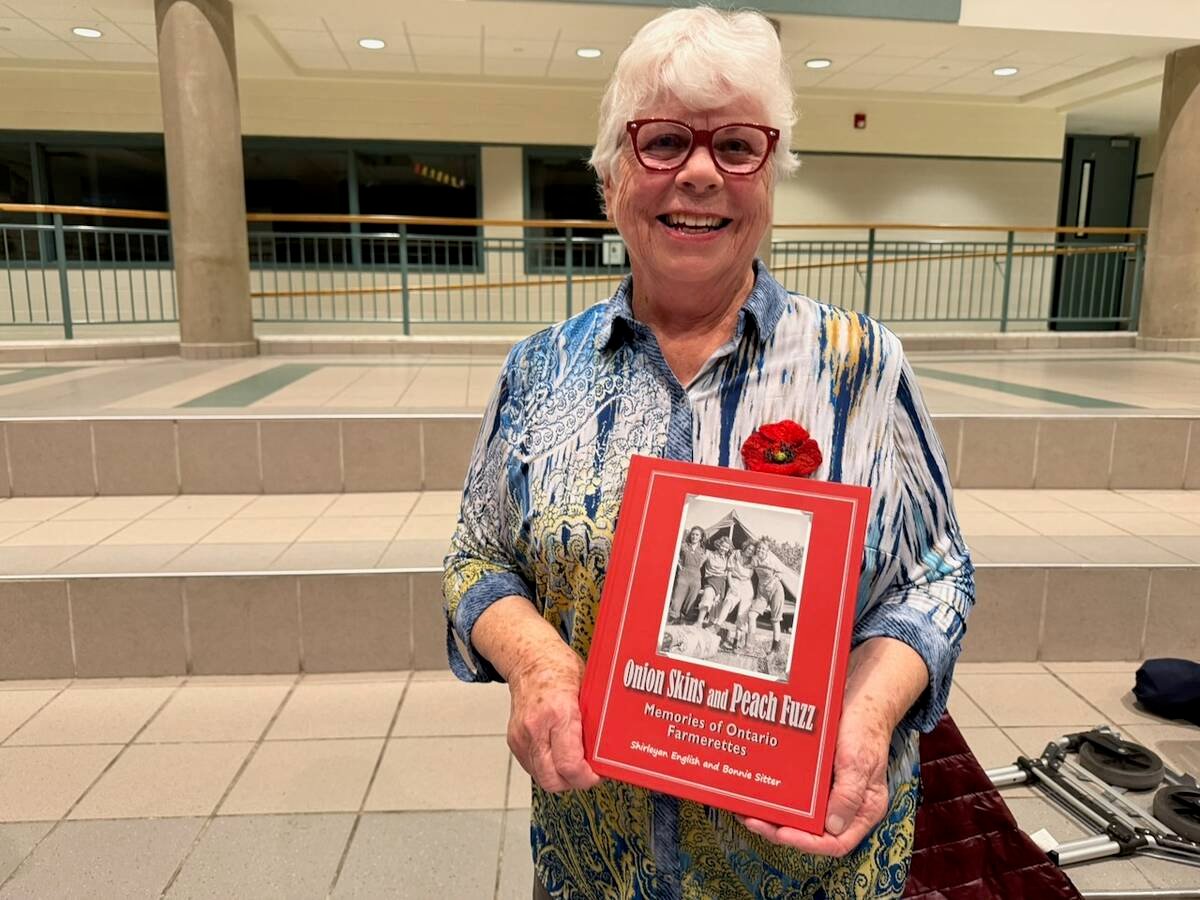

Women who fed a nation

More than 40,000 young women supported the war effort between the 1940s and early 1950s, helping grow and harvest crops amid labour shortages. They were called Farmerettes.

Baked beans.

The British fondness for baked beans on toast makes the United Kingdom a healthy market for imported navy beans, which are the basis for the staple dish.

Canada exports large amounts of navy beans to the U.K., usually about 50,000 tonnes per year, but there are a number of other suppliers in the world, including the United States.

However, the U.S. faces a tariff and sells far fewer navy beans to the entire 27 nation bloc of the European Union than Canada does to the U.K. alone.

If the U.K. crashes out of the EU at the end of October with no agreed-upon trade rules between the two, and no formal trade deals with other countries like Canada and the U.S., import and export problems and opportunities could arise, Brown said.

What happens is anybody’s guess, which might make heavily U.K. dependent markets like navy beans volatile and dramatic.

“I know we’ll figure it out, but it’s a bit of a disruption going forward,” said Brown.

This article originally appeared at the Western Producer.