Tariffs on Canadian canola oil and meal imposed by the United States and China have sunk the futures for the oilseed at the Intercontinental Exchange.

Markets/Business — page 37

ICE Weekly: No end in sight for canola’s downfall

U.S., China tariffs sink canola prices

CBOT Weekly: Prices expected to slowly recover

Unless tariffs throw a wrench into things

Corn and soybean futures at the Chicago Board of Trade are expected to slowly recover by the end of March, said broker Ryan Ettner of Allendale Inc. in McHenry, Ill. However, the tariff policies of the Trump administration could easily redirect that trend.

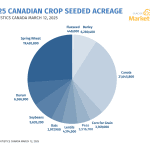

Canada to seed more wheat, less canola in 2025: StatCan

Farmers also seeding more peas, corn and oats

Canadian farmers intend to plant more wheat and less canola in 2025, according to the first survey-based estimates for the upcoming growing season from Statistics Canada released March 12. Area seeded to corn, oats and peas is also expected to rise, while soybeans, barley and lentils are forecast to lose acres.

U.S. wheat sees most notable changes in March S/D report

No change was the central theme to the March supply and demand report from the United States Department of Agriculture issued on March 11. In most categories of the World Agricultural Supply and Demand Estimates (WASDE), the USDA kept the same data as in its February report.

U.S. grains: Soybean futures end lower for third straight session; corn, wheat fall

Chicago Board of Trade soybean futures ended lower on Tuesday for a third straight session, coming under pressure from hefty South American supplies hitting the global market and uncertainty over how U.S. tariffs will affect domestic demand, traders said.

U.S. livestock: Cattle mixed, hogs down as USDA updates supply/demand numbers

Chicago mercantile exchange cattle ended mixed on Tuesday as the USDA raised its beef production forecast.

China tightens trade rules as Canadian tariffs spark price volatility

Zhengzhou Exchange on Tuesday raised the trading margin requirements for some rapeseed (canola) meal futures contracts to 9 per cent from seven per cent after Beijing's 100 per cent tariff on Canadian imports triggered a two-day rally that pushed prices to a five-month high.

Klassen: Tariff drama results in volatile feeder cattle market

For the week ending March 7, there were two distinct price structures. On Monday, March 3, feeder cattle prices were relatively unchanged from the previous week. However, once the U.S. implemented tariffs for Canadian cattle on March 4 , feeder cattle markets dropped by $10-$15/cwt on average.

U.S. grains: Soybean futures fall on weakness in oil market, China deflation worries

Chicago Board of Trade soybeans ended lower on Monday, as prices were weighed down by weakness in the oil market and traders' concern over Chinese deflation, market analysts said.

U.S. livestock: Cattle futures mostly higher

Chicago Mercantile Exchange cattle futures were mostly higher on Monday as tight supply fundamentals supported prices.