Ontario corn and soybean prices are under pressure due to heavy farmer selling. There has been no progress in regard to trade talks between the U.S. and China, which has also weighed on North American corn and soybean markets. Ontario wheat prices are modestly higher compared to two weeks earlier. We’re expecting the wheat market to rally $0.50-$0.75/bushel from current levels over the next month.

Soybeans

StatCan’s August model-based survey had the soybean crop at 3.972 million tonnes, unchanged from its previous estimate and down from last year’s crop of 4.354 million tonnes. Soybean bids from the domestic crusher are lower than values from export terminals as the market functions to encourage demand.

Read Also

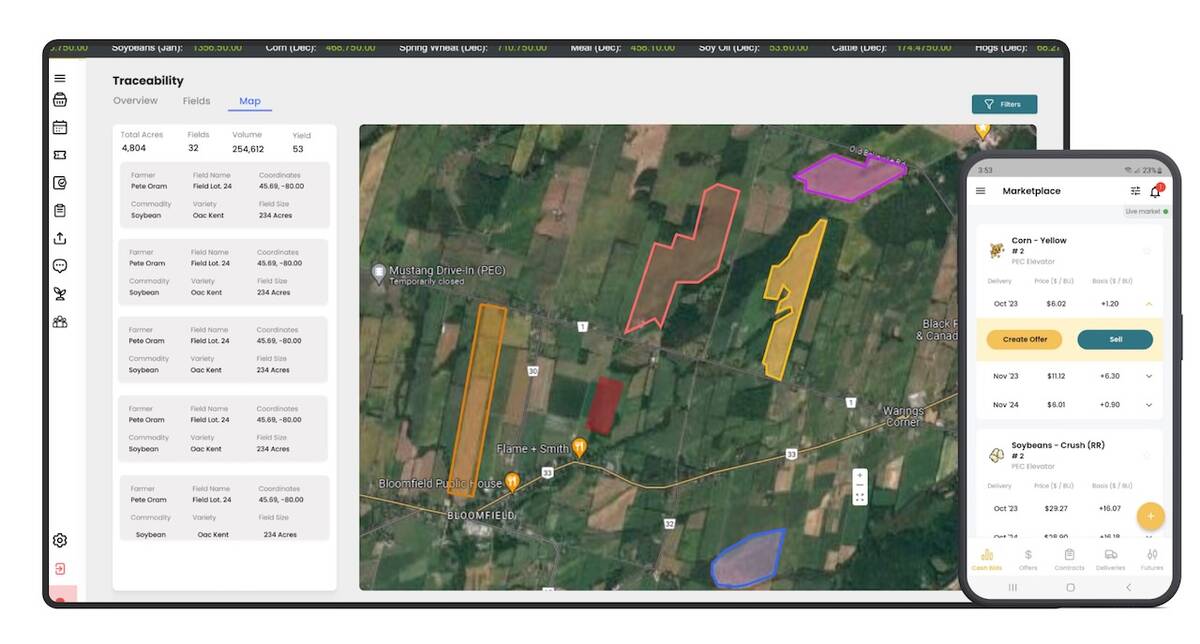

Ontario company Grain Discovery acquired by DTN

Grain Discovery, an Ontario comapny that creates software for the grain value chain, has been acquired by DTN.

It appears that local processors have their October and November demand covered. Domestic crush margins have deteriorated over the past month. Meal prices are grinding lower as U.S. crush capacity moves into high gears

Secondly, there has been a change in U.S. biofuel policy which caused soybean oil prices to drop sharply over the past couple of weeks. The U.S. Environmental Protection Agency (EPA) proposal to have large oil refineries blend the renewable fuels that smaller refineries were getting waivers to skip has become uncertain. Earlier in summer, it appeared that this would benefit supplies of soybean oil of U.S. and Canadian origin but the whole policy for biofuel blending is now in question.

U.S. soybeans usually trade to China during the fall and early winter prior to the South American harvest. The window for the U.S. competitive advantage is closing with China well stocked through November. Argentina removed the export tax on soybeans until Oct. 31 or until US$7 billion dollars of agricultural exports were sold, which was achieved on Sept. 25. China recently purchased Argentinean soybeans instead of the U.S.

On Sept. 23, Brazilian soybeans were offered at US$428/tonne f.o.b. Paranagua while U.S. soybeans were quoted at US$398/tonne f.o.b. the Gulf. Argentinean soybeans were valued at US$401/tonne f.o.b. up river port.

U.S. soybeans are providing stiff competition for Ontario origin to non-China destinations. At this stage, it looks like the U.S. will be dominating Middle East and European markets for the 2025/26 crop year, limiting access for Ontario soybeans.

What to do: This week, we’re advising Ontario farmers to move to 30-40 per cent sold on their 2025 production. The lack of progress on trade talks along with stronger competition from the U.S. will weigh on soybean prices this fall. Once the non-China demand is full, the market could fall $1/bu.

Corn

StatCan’s August model-based crop survey had the Ontario corn crop at 9.905 million tonnes, unchanged from the July survey and up from the 2024 production of 9.627 million tonnes.

U.S. and Brazilian farmers harvested record crops in 2025. The USDA estimated the corn crop at 427 million tonnes, up from last year’s output of 378 million tonnes. The Brazilian harvest, which occurred this past June was estimated at 135 million tonnes, up from last year’s crop of 119 million tonnes. The function of the corn market is to encourage demand through lower prices.

Ontario corn production is relatively the same as last year; U.S. corn output is up 49 million tonnes. At the time of writing this article, corn prices south of the border in Michigan and Illinois were priced competitively to trade to Southern Ontario ethanol processors and feedlots. The larger U.S. crop will limit the upside in the Ontario market throughout the 2025/26 crop year.

On Sept. 23, U.S. corn was offered at US$206/tonne f.o.b. the Gulf while Brazilian corn was quoted at US$213/tonne f.o.b. Paranagua. French corn was quoted at US$225/tonne f.o.b. La Pallice. Ontario corn was valued at US$202/tonne f.o.b. St. Lawrence port.

Ontario and U.S. corn are competitive into European markets; however, exports will be down from year-ago levels in the first half of the crop year. The larger European wheat crop has displaced corn in the short term which has limited offshore business for Ontario corn. Approximately 40 per cent of the European wheat crop moves into domestic feed channels. Ontario corn exports will only improve next spring.

What to do: This week, we’re advising Ontario farmers to sell 20 per cent of their 2025 corn production bringing total sales to 40 per cent. There is potential for adverse rains to delay the U.S. corn harvest. This causes the market to incorporate a risk premium. We want to be selling into this strength.

Wheat

The wheat market has been under pressure over the past couple of months due to the year-over-year increase in production from all major exporters. Farmers in Europe, Russia, and the U.S. sell a large volume of the crop during the summer and this limits any strength. We’re now starting to see export offers for winter wheat from the U.S., Russia and Europe notch higher.

There are two factors that will result in higher prices for Ontario wheat later in the crop year. First, we’re expecting larger exports of Ontario soft red winter milling quality to the U.S. The U.S. soft red winter wheat crop has some quality issues due to adverse rains. We’re also hearing of fusarium problems in the Midwest.

Secondly, we’re factoring in larger Ontario exports to Mexico, the Caribbeans and Central America. In past years Russian wheat was lower priced than Ontario due to the strong North American feed grains markets.

This year, the larger U.S. corn crop has lowered the floor price for wheat. Ontario wheat is now priced competitively to move into these markets.

Ontario soft red winter wheat prices continue to hover around $6.00/bu. delivered elevator or processor. The 52-week low occurred during the harvest period in early August of $5.85/bu. The wheat market has a strong tendency to rally $0.50-1.00/bu. during the fall period. We want to be selling into this strength. Farmers with feed quality wheat should be 30 per cent sold on their 2025 production.

What to do: This week, we’re advising producers with milling quality wheat to sell their first 20 per cent increment. The Chicago March futures have been trading at a 20 cent/bu. premium to the nearby December contract. The market is telling you to sell today for January through March delivery. You’re being rewarded for storing the wheat into winter. We have to start selling before the Argentinean and Australian harvests.