Ontario farmers made considerable planting progress during the last half of April and first half of May. Most of Ontario received normal precipitation for this time of year while temperatures were two to three degrees Celsius below normal. The U.S. row crops are being planted in a timely fashion.

Quick look:

Soybeans: A historically low soybean carryout for Ontario is predicted.

Corn: The U.S. could see a record crop.

Wheat: Ontario winter wheat production is expected to be 400,000 tonnes above 2024 results.

Read Also

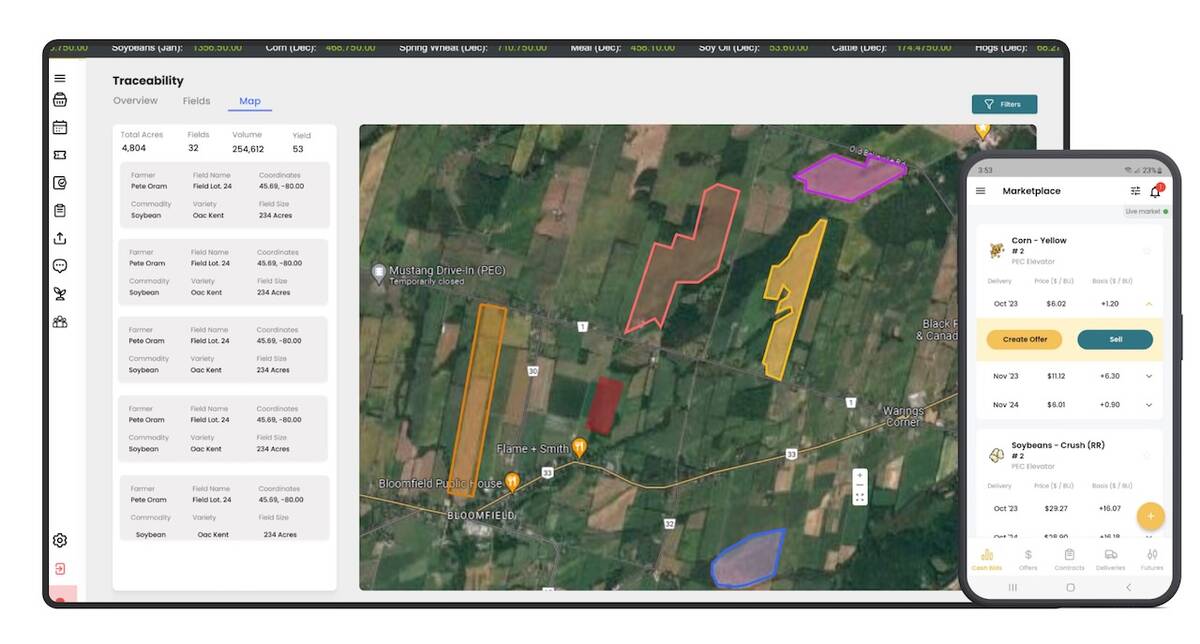

Ontario company Grain Discovery acquired by DTN

Grain Discovery, an Ontario comapny that creates software for the grain value chain, has been acquired by DTN.

Above average yields are expected for Ontario and U.S. winter wheat crops. Elevator cash bids in Ontario are relatively unchanged from two weeks ago. Statistics Canada released its March 31 Stocks Report on May 8. The report was considered neutral to bullish for Ontario corn, soybeans and wheat markets.

Soybeans

Ontario on-farm soybean stocks as of March 31 were 610,000 tonnes, down from the March 31, 2024 level of 615,000 tonnes and down from the five-year average of 700,000 tonnes. We continue to project a historically low Ontario soybean carryout for the 2024/25 crop year.

For 2025/26, the trade is using Statistics Canada acreage survey data and a five-year average yield of 50.6 bu./acre to project a 2025 crop size of 3.9 million tonnes. This is down from the 2024 crop of 4.3 million tonnes and the five-year average of four million tonnes.

During the summer of 2025, the Ontario soybean market needs to trade high enough to encourage about 250,000 tonnes of imports from the U.S. Secondly, the Ontario market needs to ration demand by trading above world values.

Traders are factoring in a U.S. soybean crop of 112-113 million tonnes, down from the 2024 output of 118 million tonnes and in line with the five-year average. China has tariffs of 135 per cent on U.S. soybeans.

Therefore, U.S. soybeans will trade to non-China destinations adding competition for Ontario soybeans in Western Europe, North Africa and the Middle East.

As of May 11, the Argentine soybean crop was approximately 20 per cent harvested. Argentinean farmers finish the soybean harvest in June. There will be pressure on world soybean oil and soybean meal markets during the summer months as new crop supplies come on stream.

Traders feel comfortable with crop estimates around 49 million tonnes, up one million tonnes from last year. Brazil will continue to dominate the world soybean market with crop estimates averaging 169 million tonnes, up from 154 million tonnes last year.

What to do: We’ve advised farmers to be 90 per cent sold on their 2024 production and 10 per cent sold on their expected 2025 output. The weather forecast for the western half of the Midwest during June and July calls for below normal precipitation and above normal temperatures. We’re looking to finish old crop sales and add onto new crop when there is a weather rally in the summer.

Corn

Total Ontario corn stocks as of March 31 totalled 4.8 million tonnes, of which 2.4 million tonnes were on-farm and 2.4 million tonnes in commercial positions. This compares to the March 31, 2024, total stocks of 5.6 million tonnes which combined 2.7 million tonnes on-farm and 2.9 million tonnes in commercial pipeline.

Given the stocks report and current demand projections, we’re now projecting an Ontario corn total carryout of 700,000 tonnes for the 2024/25 crop year, down from the 2023/24 ending stocks of 1.4 million tonnes and down from the five-year average of 1.6 million tonnes.

We’re expecting Ontario farmers to plant 2.32 million acres of corn this spring. This compares to the Statistics Canada estimate of 2.266 million acres and the 2024 area of 2.157 million acres. Using an average yield of 172.4 bu./acre, Ontario corn production has potential to reach 10 million tonnes, up from the 2024 output of 9.7 million tonnes and up from the five-year average of 9.5 million tonnes.

It appears that the Ontario corn crop is being planted in a timely fashion and an early planted crop tends to result in above average yields. A similar fundamental situation is developing in the U.S. The futures are balancing tight old crop fundamentals with the potential for burdensome supplies for new crop.

The U.S. corn carryout for the 2024/25 crop year will finish in the range of 35-36 million tonnes, down from the 2023/24 carryout of 44.8 million tonnes and down from the five-year average of 38.9 million tonnes. Old crop fundamentals are tight. Despite the lower stocks, U.S. corn remains the most competitive on the world market.

For new crop, the USDA Prospective Plantings Report had acreage at 95.3 million. However, traders are factoring in acreage between 95.5-96 million. The crop is being planted in a timely fashion under optimal conditions. Additional rains are in the forecast.

Traders are factoring in a U.S. crop around 398-400 million tonnes, up from the 2024 output of 378 million tonnes and up from the five-year average crop of 365 million tonnes. This could be a record U.S. corn crop.

The Ontario corn market is moving through a period of seasonal high demand while stocks are relatively tight. In July, we’ll likely see Ontario corn trade above Brazilian origin to curb offshore movement.

During July, Brazil will take over the dominant position on the world market and dominate the markets in Europe, which is the major home for Ontario corn. The longer-term weather forecast for the Midwest calls for above normal temperatures while the western half of the region is expected to receive below normal precipitation. We’re banking on a weather rally in late June and July. Keep this in mind.

The futures market is going to over-extend to the downside and then turn sharply higher. There is potential for the “dome of doom” over the corn belt and this will cause the market to incorporate a major production risk premium.

What to do: We’ve advised farmers to be 80 per cent sold on their 2024 corn production. We are planning to make our final sales recommendation in late June or July during the main weather rally. We also like to hold back some corn until the upcoming Ontario crop is more certain.

Wheat

Ontario on-farm wheat stocks as of March 31 were 165,000 tonnes, down from the March 31, 2024 supplies of 406,000 tonnes. We’re viewing this number as supportive for the Ontario wheat basis.

At the time of writing this article, old crop and new crop elevator bids were relatively the same. The market is confirming the tighter old crop stocks and this also suggests that domestic millers have open demand in June and July. There may be some premiums at local millers if farmers are still holding some old-crop stocks.

The Ontario winter wheat crop continues to develop under favourable conditions. We’re now expecting Ontario winter wheat production to reach 2.8 to three million tonnes, up from the 2024 crop of 2.4 million tonnes. During August and September, we may see Ontario wheat traded into domestic feed channels because corn stocks are expected to be historically tight.

We’ve bumped up our U.S. hard red winter yield. Our 2025 production estimate is now 20.5 million tonnes. This compares to last year’s crop of 20.9 million tonnes and the five-year average of 18.4 million tonnes.

Remember, the U.S. still has half of last year’s crop in the pipeline and farmers sell 50 per cent of the winter wheat during the summer months. U.S. soft red winter wheat output will finish around nine million tonnes, down from the 2024 output of 9.3 million tonnes.

The European crop is developing under favourable conditions with recent rains enhancing yield potential. EU common wheat or soft wheat output is estimated at 126 million tonnes, up from the 2024 crop of 112 million tonnes.

Russia’s crop will finish in the range of 83.5 million tonnes, up from the 2024 harvest of 82 million tonnes. Analysts have raised Russia’s production estimates given recent weather conditions. The Ukrainian wheat crop has experienced drier conditions. Earlier estimates had the crop similar to last year at 23.5 million tonnes but it will likely finish around 21 million tonnes.

What to do: We’ve advised farmers to be 100 per cent sold on their 2024 production. We don’t like to make new crop recommendations due to quality uncertainty. We’re planning our first wheat sale for 2025 in October or early November.