Feeder cattle prices across Western Canada were $2 lower to $3 higher last week depending on the location of the sale. Feeder cattle prices are running 20 per cent above year-ago levels and available financing is limiting the buying power. Despite the equity buildup over the past year, many feedlot operators and custom feeders are purchasing 15-20 per cent fewer cattle, given the larger capital costs.

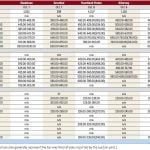

Late last week, a plain group of 60 tan steers averaging 550 pounds sold for $164 per hundredweight (cwt) in central Alberta at a presort sale. A few days earlier, 70 red/black Limo cross steers averaging 540 lbs. sold for $155/cwt in the same region. Cattle merchants also reported that sellers “passed” up on higher bids for similar type of cattle.

Read Also

U.S. grains: Soybeans tumble on doubts over U.S.-China trade progress

Chicago Board of Trade soybean futures plummeted on Friday as trade restrictions announced by China and escalating rhetoric from U.S. President Donald Trump cooled hopes of a resolution to a standoff between Washington and Beijing.

Alberta fed cattle traded $1-$2/cwt higher in comparison to a week earlier, reaching $113/cwt; the U.S. fed market was up as much as $6/cwt, touching $127/cwt in the southern Plains, making a new all-time record high.

During bullish cattle markets, the cash trade often leads the futures market, which can cause extreme volatility from week to week. This environment has also contributed to the price uncertainty in the feeder complex because feedlot operators view the fed market as unsustainable.

January and March feeder cattle futures are now trading at a similar price. This price structure, along with the factors above, will likely cause feeder cattle prices to consolidate in the short term.

The U.S. beef cow slaughter from January through September of was 2.783 million head, up from 2.67 million head for the same time frame last year. It appears that the 2011 calf crop may be lower than earlier projections. Next year, the available feeder cattle pool may be abnormally tight as heifer retention increases across all regions of the U.S.