Chariot Command is a startup company that supplies a regular and thermal camera for use in equipment which can cut down on risk of fire in farm equipment.

Corn

VIDEO: Camera system helps spot hot bearings before they catch fire

Chariot Command is a startup company that supplies a regular and thermal camera for use in equipment

Feed grains weekly: Looming tariffs scaring away demand

Feed market is ‘wait and see’ says broker

Ongoing tariff uncertainty continues to curtail demand in the feed sector across the Canadian Prairies, said broker Evan Peterson of JGL Commodities in Saskatoon.

U.S. forecaster sees neutral weather conditions persisting through summer

La Niña conditions are weakening and a shift to an El Niño-Southern Oscillation (ENSO) neutral weather pattern is expected to develop in April and persist through the Northern Hemisphere summer, a U.S. government weather forecaster said on Thursday.

U.S. grains: Chicago grains and soybeans extend losses as trade fights roil

Chicago Board of Trade grain and oilseeds extended losses on Wednesday after a government crop report showed more U.S. corn inventories than expected, while the latest U.S. tariffs and European counter-measures fueled concerns about trade disruption, traders said.

CBOT Weekly: Prices expected to slowly recover

Unless tariffs throw a wrench into things

Corn and soybean futures at the Chicago Board of Trade are expected to slowly recover by the end of March, said broker Ryan Ettner of Allendale Inc. in McHenry, Ill. However, the tariff policies of the Trump administration could easily redirect that trend.

Ontario farmers to plant more corn, less soybeans in 2025: StatCan

Farmers also seeding more peas, corn and oats

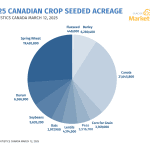

Canadian farmers intend to plant more wheat and less canola in 2025, according to the first survey-based estimates for the upcoming growing season from Statistics Canada released March 12. Area seeded to corn, oats and peas is also expected to rise, while soybeans, barley and lentils are forecast to lose acres.

Canada to seed more wheat, less canola in 2025: StatCan

Farmers also seeding more peas, corn and oats

Canadian farmers intend to plant more wheat and less canola in 2025, according to the first survey-based estimates for the upcoming growing season from Statistics Canada released March 12. Area seeded to corn, oats and peas is also expected to rise, while soybeans, barley and lentils are forecast to lose acres.

U.S. wheat sees most notable changes in March S/D report

No change was the central theme to the March supply and demand report from the United States Department of Agriculture issued on March 11. In most categories of the World Agricultural Supply and Demand Estimates (WASDE), the USDA kept the same data as in its February report.

U.S. grains: Soybean futures end lower for third straight session; corn, wheat fall

Chicago Board of Trade soybean futures ended lower on Tuesday for a third straight session, coming under pressure from hefty South American supplies hitting the global market and uncertainty over how U.S. tariffs will affect domestic demand, traders said.

U.S. grains: Soybean futures fall on weakness in oil market, China deflation worries

Chicago Board of Trade soybeans ended lower on Monday, as prices were weighed down by weakness in the oil market and traders' concern over Chinese deflation, market analysts said.