MarketsFarm — The size of the fund short position in continued to rise in early March, according to the latest Commitments of Traders data out from the U.S. Commodity Futures […] Read more

Tag Archives cftc

Canola fund short position still rising

Managed money net long in soybeans

Confirmation of large canola short position slowly appears

CFTC data flow slowly resuming

MarketsFarm — The size of the fund short position in canola rose in February and likely grew even larger in March, as weekly Commitments of Traders data slowly trickles out […] Read more

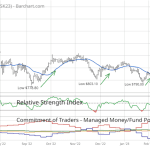

Reading between the lines: Oversold canola due for correction

Technical signs point to possible recovery

MarketsFarm — Canola futures posted sharp losses over the past week, with the May contract touching its weakest level in six months. While damage was done from a chart standpoint, […] Read more

Spec short position grows in canola

Managed money net long in soy, corn

MarketsFarm — Speculators were busy adding to their growing net short position in canola during the week ended Jan. 24, according to the latest Commitments of Traders (CoT) report compiled […] Read more

U.S. livestock: CME cattle futures sag on long liquidation, rising grains

Hogs end mixed as traders' net long position shrinks

Chicago | Reuters — Chicago Mercantile Exchange live cattle futures fell on Tuesday, on spillover weakness from feeder cattle futures and long liquidation as market players responded to a hefty […] Read more

Fund traders flip back to short side on canola

Corn traders reduce net long position

MarketsFarm — After briefly holding a net long position to start the New Year, speculators were back holding a net short position in canola in the second week of January […] Read more

Fund traders back on the long side in canola

Net long also extended in CBOT corn, soy

MarketsFarm — Speculators in ICE canola moved back to a net long position in the futures to start the New Year, according to the latest Commitment of Traders (CoT) report […] Read more

Speculative short position grows in canola

Managed money still net long in soybeans

MarketsFarm — Speculators in the ICE Futures canola were busy liquidating long positions and adding to the short side of the market during the last week of November. That’s caused […] Read more

Fund position back to net short in canola

MGEX wheat also shifts to net short: CFTC

MarketsFarm — Heavy long-liquidation in ICE Futures canola saw the managed money speculative position flip back to a net short after a brief flirtation with a net long, according to […] Read more

Fund position switches to net long in canola

Net long in CBOT corn decreases on the week

MarketsFarm — The overall speculative position in the ICE Futures canola market swung from net short to net long during the first week of November, marking the first time speculators […] Read more