Agriculture and food processing contribute significantly to the Ontario economy, according to a recent study from the Ontario Federation of Agriculture (OFA).

Ben LeFort, senior farm policy analyst at OFA outlined findings in a webinar Feb. 5. According to LeFort, $18 billion in direct farm revenue grows to $30 billion in total business revenue in the province.

Why it matters: Agriculture and food are not always recognized for the size of contribution they make to the Ontario economy.

Read Also

Ontario’s other economic engine: agriculture and food

Ontario Federation of Agriculture president, Drew Spoelstra, says Ontario’s agriculture and agri-food sector should be recognized for its stability and economic driving force.

“Farmers collected $18 billion in initial revenue and an additional $12 billion in business revenue is created from farmers buying seeds, buying tractors, buying all of the things they need to produce” their commodities, he said. “And then an additional $4 billion in business revenue comes … from workers in the ag sector spending their wages on local businesses.”

Outside of on-farm activities, the food manufacturing sector also contributes significantly to the provincial GDP. LeFort said the sector’s total revenues are around $51.5 billion.

“Once we consider all of the other effects, the indirect effects … all the workers that work in food manufacturing industry, spending their money, we get to nearly $98 billion in business revenue.”

Food manufacturing also accounts for around 585,000 jobs in the province.

LeFort also discussed results from OFA farm business confidence surveys, which identified key policy priorities for the province. These included reducing tax burden, supporting farmers with energy costs and encouraging Ontarians to buy local food, which he said has only become more relevant in light of U.S. tariff threats. Access to high speed internet is also a priority for farmers in the surveys.

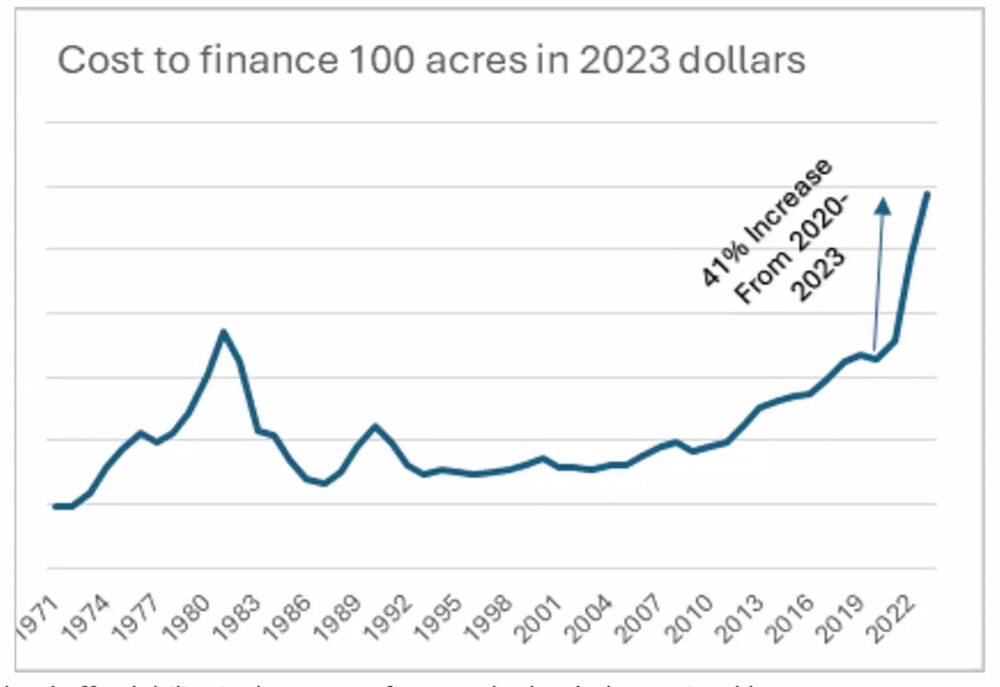

Another major issue was farmland affordability, which LeFort said has been on a steady decline in recent years, with a spike in 2023 brought on by an increase in borrowing costs. Grain prices have also declined in that time, while farm-related input costs have increased.

The OFA has now called for amendments and modernizations to the farming family exemption under land transfer tax and the farmland property class tax rate program, to “acknowledge that when the time these folks put into place, farm incorporation was much less common, and this type of multiple program structure was much, much, much less common.”

American farmers get preferential tax treatment compared to Canadian farmers, LeFort said.

Farmers pay more in property tax to their local municipalities and LeFort says they are hearing that from the OFA’s members.