Glacier FarmMedia – An updated report from the Parliamentary Budget Officer (PBO) shows that Canadian farmers on the Prairies and in Ontario could pay $184 million annually in carbon tax by 2030.

The report released Jan. 20 outlines the cost of extending the exemption on qualifying farm fuel to natural gas and propane, as the private members’ Bill C-206 in the previous Parliament outlined.

Why it matters: Carbon taxes are an additional farm expense that could affect the bottom line. Several efforts have been made to exempt natural gas and propane from the tax.

Read Also

Footflats Farm recognized with Ontario Sheep Farmers’ DLF Pasture Award

Gayla Bonham-Carter and Scott Bade, of Footflats Farm, win the Ontario Sheep Farmers’ 2025 DLF Ontario Pasture Award for their pasture management and strategies to maximize production per acre.

An earlier costing note, released last June, showed costs over five years and was updated to show the increasing tax rate up to $170 per tonne.

Looking at it another way, the estimates are what farmers would pay without an extension of the exemptions.

Conservative agriculture critic John Barlow said the numbers are telling.

“It will cost farmers more than $1 billion,” he said, adding that one farmer told him his carbon tax bill was $11,000 in December alone.

“He said, ‘I can’t carry this. I just don’t have the margins,” Barlow said.

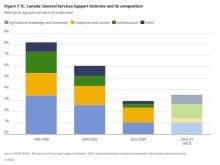

The breakdown shows that Ontario by far will be hardest hit, with the total at $25 million this year and $108 million by 2030-31.

Alberta will see the cost go from $10 million to $46 million per year and in Saskatchewan the cost rises from $6 million to $28 million. The estimate for Manitoba projects no costs for 2021-22 and $2 million by 2030-31.

In total, more than $1.1 billion will come out of farmers’ pockets if they have to pay the tax.

“This is pretty eye-opening,” said Barlow.

He said tacking on extra costs from the proposed reduction in fertilizer use will be the death knell for some farmers.

“How are farmers going to afford to stay in business?” Barlow said. “What incentive is there to stay?”

He expected the private members’ bill, which didn’t make it through the Senate before the last Parliament prorogued, would be tabled again early in the new parliamentary session that began Jan. 31.

On Feb. 8, Ben Lobb, Ontario Conservative MP for Huron-Bruce, tabled a new bill, Bill C-234, an Act to amend the Greenhouse Gas Pollution Pricing Act (qualifying farming fuel).

Barlow also said the carbon tax rebate plan set out in the fall economic statement isn’t a solution because farmers will have to pay the tax first and wait to get their money back. Barlow said some could be bankrupt by that time.

– This article was originally published in The Western Producer.