Farm Credit Canada has new support for farmers facing financial difficulties.

On May 23, the lender announced it will offer unsecured credit lines up to $500,000 to agricultural producers and will waive loan processing fees. A similar offer was extended to the hog sector.

Why it matters: Unsustainable debt following interest rate spikes has wreaked economic havoc in the past.

Read Also

Ontario Agricultural Conference increases accessibility

The Ontario Agricultural Conference 2026 offers in-person and online access to expert insights, hands-on learning, and networking opportunities.

Perry Wilson, FCC senior vice-president of operations, cited two main reasons behind the decision: the rising cost of inputs and ballooning interest rates.

The May 23 release pointed to a “period of elevated costs,” which has generated extra strain.

“Supply chain issues have created impact on input costs, which is another reason why we provided this tool to assist with that,” Wilson said.

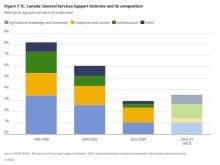

Loans could help individual farms manage debt, which has been on the rise since 2010. According to Statistics Canada, farms went from owing a collective $65 billion in 2010 to $138.5 billion in 2022. The largest lenders every year were chartered banks, followed by federal government agencies.

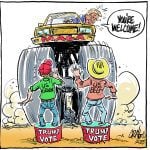

Canada also experienced a farm debt crisis in the 1980s. Interest rates pushed past 20 per cent in the early part of that decade. On the farm, the price of many agricultural commodities plummeted. The number of farms dropped with it as farmers were forced out of business.

Today, with rising farm debt, higher interest rates and expensive land prices, are conditions forming for another crisis? Experts say it’s doubtful.

“The combination of falling crop prices and rising interest rates sounds like conditions in the early 1980s that led to the debt crisis of the mid-1980s,” University of Guelph professor Alfons Weerkin said via email.

“Margins in the crop sector are getting tighter as crop prices have fallen. While some expenses have also fallen, such as fertilizer, other major costs like rent and loan repayments have continued to rise.

“However, I think there are two major differences. One is that farmers have had a prolonged period of relative prosperity since late 2006 and so are in a better overall financial position than in the early 1980s to weather a downturn.”

The other difference is that, while interest rates are high, they’re not early-1980s high.

Eric Micheels, associate professor of agriculture and resource economics at the University of Saskatchewan, said he thinks the industry is in a healthy position, despite debt levels and setbacks including supply chain issues caused by the war in Ukraine.

Like Weerkin, he noted interest rates are not as drastic as they were during the previous crisis.

“I think we’re a long way away from 16, 17, 18 per cent interest,” he said.

In an emailed statement, Ken McEwan, professor of agribusiness and economics at the University of Guelph, said FCC’s announcement of new loan support is not unusual.

The proposed assistance “is not abnormal with offering flexible payment options and the possibility of restructuring business loans,” he wrote. “We see this happening in other non-ag parts of the Canadian economy.”

For example, mortgages might see similar restructuring options.

“This announcement to work with farmers on a case-by-case basis is probably reasonable. Depending on the sector, margins have been tight or negative for a few months,” he added.

“Most farm sectors have performed well in the last couple of years despite the challenges. I assume the goal is to maintain vibrant sectors and sustainable farms.

“I am normally cautious on farm assistance programs, but if a balanced approach is used on an individual basis, it should be okay,” McEwan said.

Micheels said a key factor in avoiding a repeat of the 1980s will be the ability of older farmers to draw on memories of the crisis and help the younger generation avoid a similar situation.

“Farmers that are farming now remember those times,” he said. “So I think they’re wanting to protect themselves from that. They’ve built a lot of equity and it took a lot of work to build that equity, paying those incredible interest rates.”