Mention the word “fertilizer” and nitrogen first comes to mind, given its place in the production of cereals and corn.

But phosphate is also an important fertilizer for Canada’s agri-food sector, and like nitrogen, geopolitical concerns around the world and our closest trading partner means increased costs and concern about supply

Why it matters: The demand for increased crop production continues, placing stress on domestic consumption but also in feeding the world. That makes the search for domestic sources of phosphate as much about self-sufficiency as it is food security.

Read Also

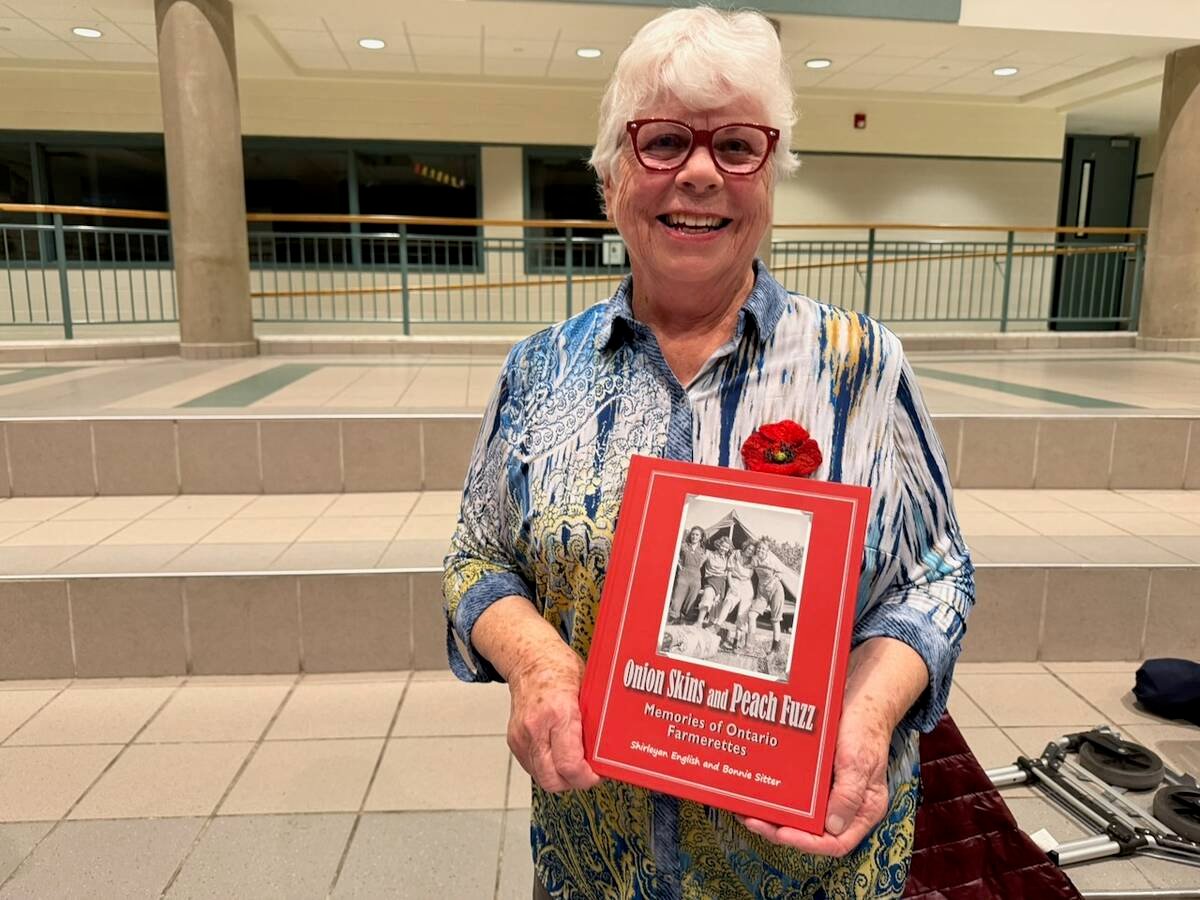

Women who fed a nation

More than 40,000 young women supported the war effort between the 1940s and early 1950s, helping grow and harvest crops amid labour shortages. They were called Farmerettes.

According to Stephen Case, chief executive officer and president of Fox River Resources, Canada has become completely reliant on phosphate sourced from other countries, historically from the U.S. but also from Russia and Morocco. He’s advocating to have the Martison Phosphate Project developed at a site northeast of Hearst to alleviate Canadian reliance on phosphate from those other jurisdictions.

Dating back to the early 2000s, Canada sourced its own phosphate, most of which came from Redwater, Alberta. At the turn of the century, that plant could generate up to 700,000 tonnes of monoammonium phosphate (MAP) per year, part of a near one-million tonne market for MAP across Western Canada. Through the years, it produced under the names Agrium, Sherritt Gordon and Veridian, among others. But with the formation of Nutrien, the phosphoric acid plant was converted to an ammonium-sulphate (AMS) production facility.

Since the mid-2010s, Canadian phosphate usage has pushed the industry into complete dependence on the U.S. and other imports. With the onset of the war in Ukraine, Canadian farmers were forced to pay higher short-term prices for phosphate from that part of the world.

“We’re now a two-million tonne market and two things have happened in the past 20 years,” says Case. “Agrium had a fixed number of tonnes they would produce per year, but the western Canadian market and Ontario’s continued to grow and they have essentially doubled consumption in the past 10 years.”

At the same time, U.S. supply has been declining since the early 1990s, from a high of about 48 million tonnes in 1991 to a little under 20 million in 2022. There is the possibility that Nutrien’s White Springs, Florida facility will close later this decade or earlier, due to a lack of phosphate reserves. That plant has produced 500,000 tonnes of phosphoric acid, but its closure will only worsen the North American shortfall of phosphate.

A solution

Case’s bid is a two-pronged approach. First, get phosphate on the 2024 Critical Mineral List (CML), a move which would help get the Martison Phosphate Project up and running. Projects like Martison require billions of dollars to build and it will need access to government support that comes with being on the critical mineral list.

“It accesses infrastructure funding, tax credits and possibly government guarantees,” says Case. “The federal government’s also involved in streamlining the permitting process to reduce the timelines for critical minerals. It’s all of those things that make it easier to get this developed — and it should be on the list — potash is, and clearly, if you look at the criteria for critical minerals, one of the aspects is food security.”

Getting phosphate on the CML can also affect the level of infrastructure support with Indigenous participation, a jump to 75 per cent compared to 50 per cent for non-Indigenous interests.

One key strategic advantage of the Martison Phosphate Project is that it originates from igneous rock versus sedimentary sources which contain higher levels of cadmium. Within the last 10 years, cadmium has become a trade issue among EU importers of cereals and other foods. Again, with increased demand for production of crops across the country, Case says it’s counterproductive to apply lesser-quality phosphate to farmland when there is a better, made-in-Canada solution.

What’s needed is the drive to get it into production.

Competition from EVs

As if getting on the CML and generating support for the Martison Project isn’t daunting enough, Case says the focus on lithium iron phosphate (LFP) batteries for the electric vehicle market could divert attention from food and fertilizer. The size of the Martison Phosphate Project is unknown at this time and although there may be enough ore to fill both markets, the two are definite competitors.

“Part of what we’re talking about is predicated on the fact that the U.S. is running out of rock and the rock they do have is of poor quality,” adds Case.

“If we don’t do something about this, we’re going to be paying more for something we shouldn’t be.”