Glacier FarmMedia – A private member’s bill introduced Feb. 7 to exempt more farm fuels from the carbon tax likely won’t pass before a government bill that will provide rebates.

Ben Lobb, Conservative MP for Huron-Bruce, introduced C-234, calling it “the fairness for farmers act.”

It would eliminate the carbon tax on natural gas and propane used to dry grain, heat barns, steam flake and irrigate, in Ontario, Alberta, Saskatchewan, and Manitoba. It is similar to Bill C-206, which died in the Senate at last summer’s election call.

Read Also

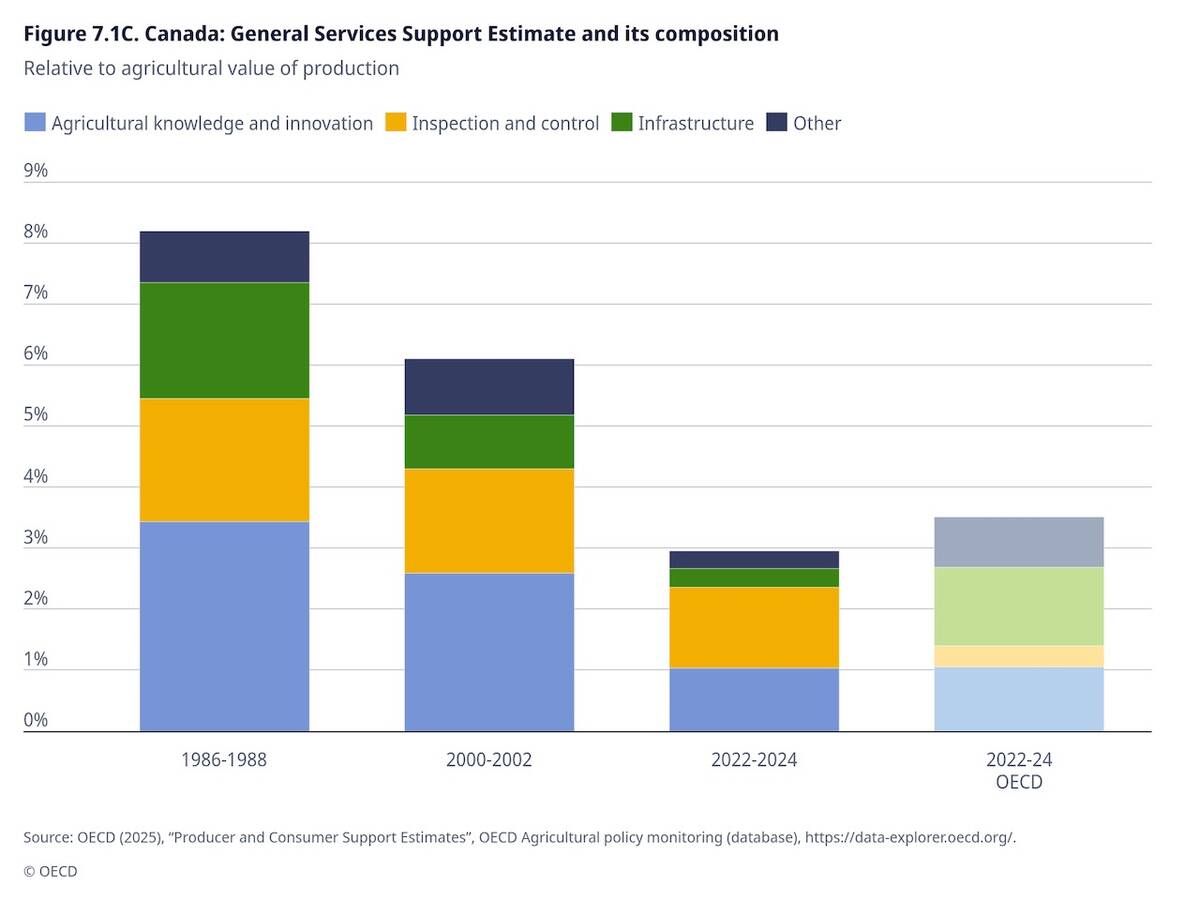

OECD lauds Canada’s low farm subsidies, criticizes supply management

The Organization for Economic Co-operation and Development lauded Canada’s low farm subsidies, criticized supply management in its global survey of farm support programs.

Why it matters: A carbon tax system that continues to rise in value will become increasingly expensive for farmers.

“For far too long, farmers have paid tens of thousands of dollars of carbon tax to provide food for Canadian families, and it is time to right that wrong,” Lobb said in the House of Commons.

However, the Liberal government has also introduced C-8, an “Act to implement certain provisions of the economic and fiscal update tabled in Parliament on Dec. 14, 2021 and other measures.”

C-8 provides for carbon tax rebates based on eligible farm expenses. It has already passed second reading and moved to the finance committee.

Adam Chambers, Conservative MP for Simcoe North and a committee member, said the bill acknowledges the government was wrong but doesn’t go far enough to fix the problem.

He said the rebate is complicated and means more work for farmers.

“It puts an additional burden on farmers to collect their receipts, and at the end of the year they will get a fraction of what they paid in carbon tax back. A tax credit is not good enough,” he said in the House. “Farmers deserve much more than that.”

Chambers produced some bills farmers had sent him.

“Just for the month of October to November, a natural gas bill for the farmer was almost $58,000. The carbon tax on that bill was $13,000. That is an unbelievable additional cost added to the monthly cost of operating that farmer’s enterprise,” he said. “Another farmer, Will, in my riding spends $40,000 to $50,000 some months on fuel.”

In an interview, Chambers said the government could have chosen to incorporate the previous agreement on C-206 into C-8.

In finance committee Feb. 14, officials said under C-8 farmers in the four provinces would receive a total of $100 million in the first fiscal year of the program at an administrative cost of $3 million.

Northumberland-Peterborough South MP Philip Lawrence asked officials what the average rebate would be and how many would actually get all their money back.

He suggested the rebate will be between 30 and 40 cents on the dollar.

“That’s what the agricultural community tells us, so we can say that an exemption is far better for farmers when we look at percentage of recovery,” Lawrence said.

He also said farming expenses are not the same across the country and he said the proxy amounts being used for the rebate — $1.47 per $1,000 of eligible farming expenses this tax year and $1.73 in 2022 — create inequities.

– This article was originally published at The Western Producer.