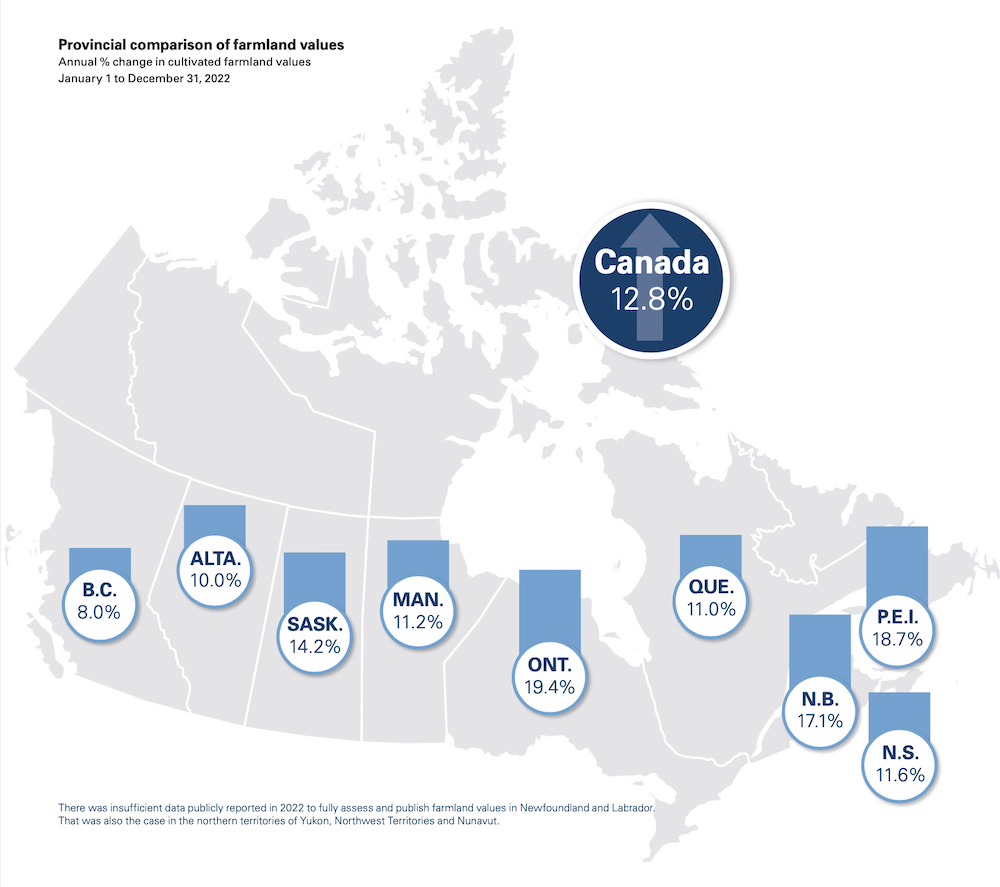

Glacier FarmMedia – Ontario farmland prices led the nation with an average increase of 19.4 per cent, well above the Canadian average increase of 12.8 per cent.

The data was released in a Farm Credit Canada report on March 13. This year’s increase follows a record increase of 22.2 per cent in 2021 and a 4.7 per cent increase in 2020.

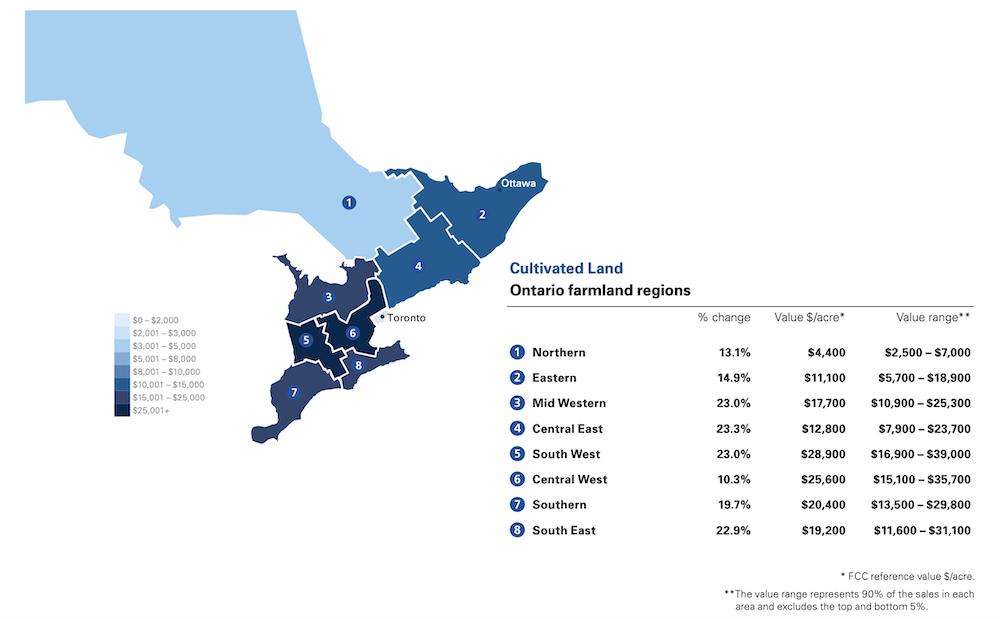

Several areas in the province recorded increases above the provincial average, including the southwest (23 per cent), southeast (22.9 per cent), mid-west (23 per cent), central east (23.3 per cent) and southern region (19.7 per cent).

Read Also

Melancthon faces a new quarry fight over water, environment and farmland risks

A proposed Strada blast quarry in Melancthon, Ont., sparks regional debate over water protection, farmland sustainability, and Ontario’s aggregate policy.

Why it matters: The cost of farmland is a factor in farm profitability, especially as interest rates have risen over the past year.

Areas of the province that had values lower than the provincial average included the eastern region (14.9 per cent), the northern region (13.1 per cent) and the central west region (10.3 per cent).

The FCC report notes that stable or increasing demand, along with limited supply in many areas of the province, led to these higher values. Demand was high from large, intensive, supply-managed farm operations, cash crop producers, hobby farmers and investors in areas close to large urban centres. Areas that saw large increases in 2021 were more stable in 2022.

Nationally, the 12.8 per cent increase was the largest seen since 2014 (which had a national increase of 14.3 per cent), and it follows gains of 8.3 per cent in 2021 and 5.4 per cent in 2020.

J.P. Gervais, FCC’s chief economist, said the numbers were a bit of a surprise.

“At this exact same time a year ago, I said that I expected the rate of increase to be smaller than the 2021 rate of increase,” said Gervais. “That was my expectation. Up until very recently, I did not think that we were going to get 12.8 per cent.”

Gervais said he had thought challenging economic conditions would slow the demand for farmland, but the picture became clearer in recent months.

“It’s all about supply and demand. On the demand side, we might find it a little surprising that demand remains as strong as it has, given high interest rates and high input costs. But the flip side of that is that we’ve had strong receipts as well,” he said, noting that receipts for grains, oilseeds and pulses increased 18.3 per cent in 2022.

“And on the supply side, all the data that we collected weighed out to a very tight supply of farmland available for sale.”

The highest average provincial increases in farmland values were observed in Ontario, Prince Edward Island and New Brunswick, with increases of 19.4, 18.7 and 17.1 per cent, respectively. Saskatchewan followed with a 14.2 per cent increase. Five provinces had average increases below the national average: 11.6 per cent in Nova Scotia, 11.2 per cent in Manitoba, 11 per cent in Quebec, 10 per cent in Alberta and eight per cent in British Columbia. There was insufficient data to fully assess farmland values in other regions of the country.

Gervais said there are a few things to note about the data in the report.

Because the report is based on the calendar year, the effect of the drought on the Prairies in 2021 is still acting as a drag on land prices and may explain the difference in increases when compared to Ontario, which didn’t suffer through the drought. But Gervais said not to draw too much from those differences.

“It’s getting harder to generalize about what’s going on in the marketplace, even within a province,” he said.

The second thing to note is that interest rate increases haven’t yet worked their way through the system.

“We have not yet seen the full impact of higher interest rates on the demand for farmland,” said Gervais, noting the reason for the lag is that people locked in when rates were lower.

Another point worth noting is that land values relative to farm income are as high as they’ve ever been. “In most if not all provinces, we’re getting very near the top of the market ever in terms of the value of land relative to farm income,” he said.

Gervais acknowledged that higher farmland values pose a challenge for young producers, new entrants, and other operations looking to expand. A strong risk management plan is critical, especially if they are looking to buy land.

“You need to have an elaborate strategic plan for your operation over the next five years and a strong risk management plan that goes with it,” he said.

“Land is more expensive now, relative to income, than it’s ever been. The ability to service debt and overall equity in the operation are critical factors of success going forward.

“The good news is that farmland value increases reflect a positive outlook for the demand for agriculture commodities and the quality food we produce in Canada.”

– A version of this article was originally published at AgCanada.com.