Chicago | Reuters — Chicago Mercantile Exchange live cattle closed higher on Thursday, with support from fund buying after contracts broke through moving-average resistance levels, traders said.

Short covering contributed to CME live cattle advances, they said.

Futures drew more support from their discounts to this week’s prices for market-ready or cash cattle.

Cash cattle in Texas and Kansas sold at mostly $143 per hundredweight (cwt), down $1 from last week (all figures US$). Cash cattle in Nebraska moved at $143, $2 to $3 lower than a week ago.

Read Also

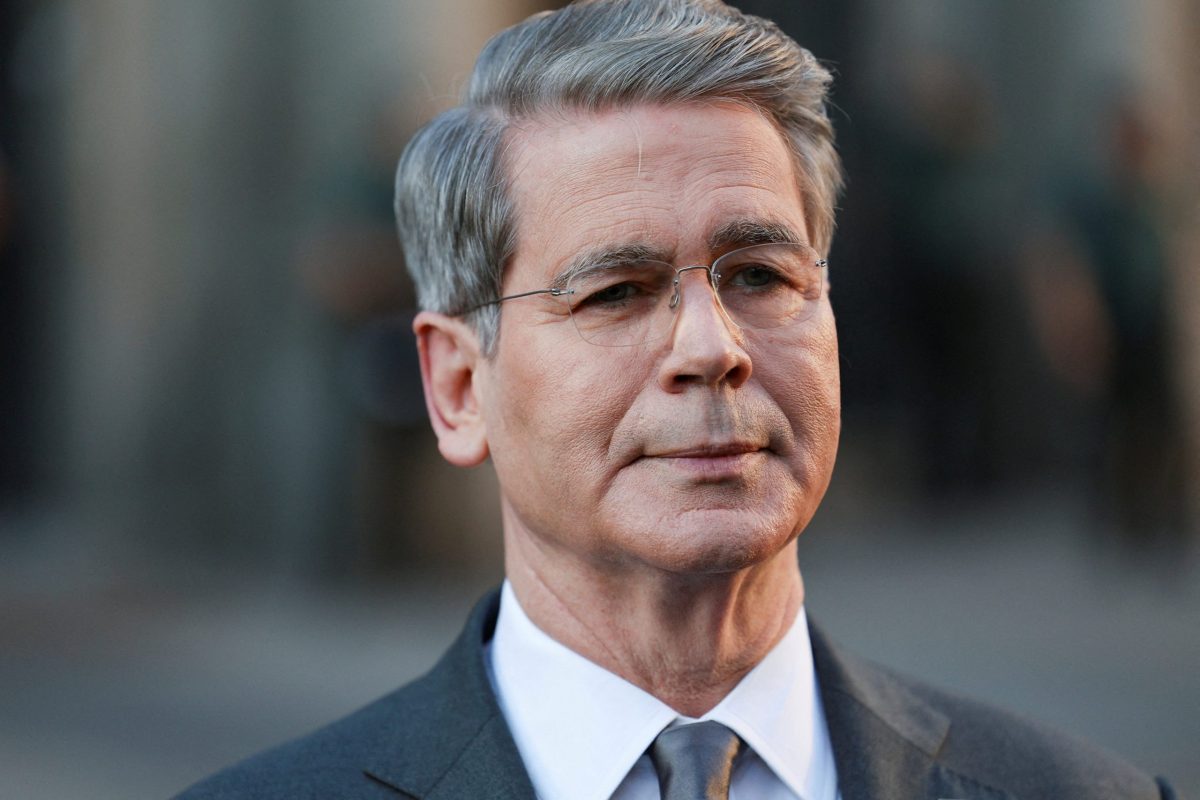

China to buy 12 million metric tons of soybeans this season, Bessent says

U.S. Treasury Secretary Scott Bessent said on Thursday that China has agreed to buy 12 million metric tons of American soybeans during the current season through January and has committed to buying 25 million tons annually for the next three years as part of a larger trade agreement with Beijing.

Packers kept a lid on cash cattle prices by cutting back slaughter rates, which significantly improved their margins.

Beef packer margins for Thursday were at a positive $88.95 per head, compared with a positive $75.85 on Wednesday and a positive $41.50 a week ago, as calculated by industry analytics firm HedgersEdge.com.

While evening up positions on the last trading day of the month, investors on Friday will monitor wholesale beef prices that eased on Thursday.

The afternoon’s wholesale choice beef price dropped 66 cents/cwt from Wednesday to $233.65. Select cuts slipped 38 cents to $223.77, said the U.S. Department of Agriculture.

June ended at 138.025 cents, up 1.875 cents and above the 20-day moving average of 137.708 cents. August rose 2.075 cents to 139.175 cents, topping the 10-day moving average of 138.533.

CME feeder cattle hit a new high, fueled by higher live cattle futures and lower corn prices.

August finished 1.475 cents per pound higher at 197.05 cents, and September was up 1.575 cents at 198.075 cents.

Nearby hogs down, others up

CME hog contracts for June and July felt pressure from lower cash and wholesale pork prices, traders said.

Thursday morning’s hog price in the Iowa/Minnesota market fell $2.28/cwt from Wednesday to $105.83, the USDA said.

USDA data showed the morning’s wholesale pork price sagged $1.73/cwt from Wednesday to $113.52.

Some packers have sufficient supplies of hogs and retailers booked less pork heading into the weekend, a trader said.

Futures’ premium to CME’s hog index, at 110.98, discouraged buyers.

Speculative buying in anticipation of tight supplies pegged to the porcine epidemic diarrhea virus lifted August and October futures.

June and July hogs are poised to take on their respective 100-day and 40-day moving averages of 115.774 cents and 122.346 cents.

June hogs closed down 0.25 cent/lb. at 114.3 cents, and July was 0.675 cent lower at 120.6.

August ended up 0.125 cent at 124.9 cents and October was 0.8 cent higher, at 106.

— Theopolis Waters reports on livestock futures markets for Reuters from Chicago.