Chicago | Reuters — Chicago Mercantile Exchange lean hog futures rose on Friday as tight hog supplies and strong demand fueled gains for the fifth time in six sessions.

The market shrugged off negative technical signals following a lower close in actively traded April futures on Thursday after posting a contract high during the session.

The benchmark contract has rallied nearly 20 per cent in the past four weeks amid tightening supplies and solid domestic and export demand.

“The hog numbers are tight, we believe they are going to stay tight and the demand is going to stay strong all the way into the summer,” said Don Roose, president of U.S. Commodities in West Des Moines, Iowa.

Read Also

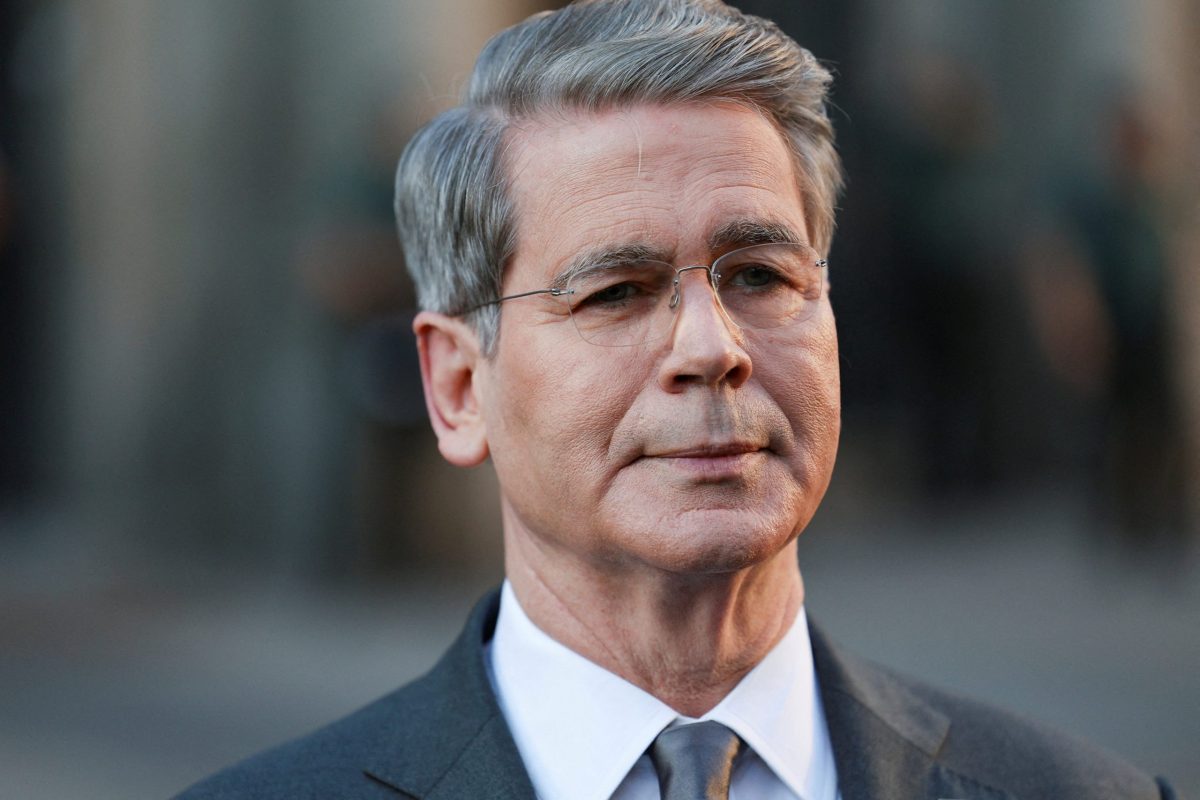

China to buy 12 million metric tons of soybeans this season, Bessent says

U.S. Treasury Secretary Scott Bessent said on Thursday that China has agreed to buy 12 million metric tons of American soybeans during the current season through January and has committed to buying 25 million tons annually for the next three years as part of a larger trade agreement with Beijing.

CME April lean hogs settled 1.7 cents higher at 100.075 cents/lb., near the high for the day (all figures US$). Several deferred-month contracts posted contract highs.

Reduced hog slaughter rates this week following a severe winter storm in production areas across the Midwest, and some packing plant staffing problems due to coronavirus infections, were likely to underpin pork prices, traders said.

The U.S. Department of Agriculture (USDA) estimated the week’s hog slaughter, through Friday, at 2.233 million head, down from 2.332 million last week and 2.391 million a year ago.

Live cattle futures ended mostly higher, underpinned by higher cash market prices and solid packer demand amid increased slaughter rates.

Cattle at southern Plains feedlots traded $1-$3/cwt higher this week at $138-$140/cwt.

The cattle slaughter through Friday was estimated at 593,000 head, up from 586,000 a week ago and 584,000 a year ago, according to USDA.

CME April live cattle ended up 0.125 cent at 146.875 cents/lb. March feeder cattle fell 0.625 cent to 166.1 cents/lb. after reaching a two-month peak for a spot contract on Thursday.

— Karl Plume reports on agriculture and ag commodities for Reuters from Chicago.