Chicago | Reuters — U.S. soybean, wheat and corn futures rose on Wednesday, with the Federal Reserve’s announcement that it will be less patient in normalizing monetary policy jolting the market to session highs late in the trading day.

Bargain buying and short covering also were supportive factors for the agricultural commodities.

The Federal Reserve’s move, which opened the door further for an interest rate hike, sent the dollar sharply lower, a bullish factor for U.S. commodities.

“The late collapse in the dollar helped bring the grain markets back to the plus side,” said Greg Grow, director of agribusiness at Archer Financial Services.

Read Also

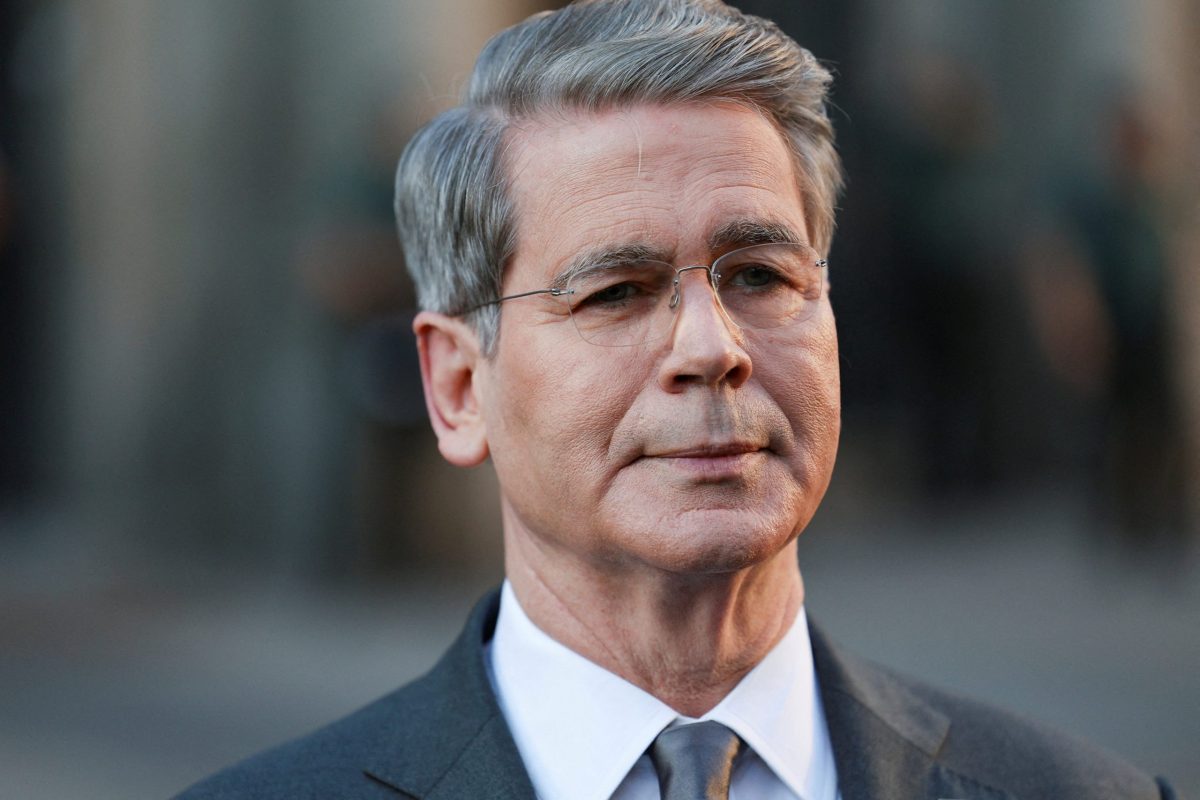

China to buy 12 million metric tons of soybeans this season, Bessent says

U.S. Treasury Secretary Scott Bessent said on Thursday that China has agreed to buy 12 million metric tons of American soybeans during the current season through January and has committed to buying 25 million tons annually for the next three years as part of a larger trade agreement with Beijing.

Wheat futures, which are most sensitive to moves in the dollar as overseas supplies are priced in local currencies, received the biggest boost after trading in negative territory for much of the day.

Chicago Board of Trade May soybeans settled up 10-1/2 cents at $9.65 a bushel.

CBOT May corn was 3-3/4 cents higher at $3.74-3/4 a bushel. The front-month corn contract hit its lowest since Jan. 30 early in the session.

CBOT May wheat gained 7-1/4 cents to close at $5.10-3/4 a bushel, breaking through its 30-day moving average ahead of the close.

But dim export prospects continue to hang over the market as the corn and soybean harvests in Brazil and Argentina neared the halfway point.

“Ships are lined up and getting loaded there,” commodity brokerage INTL FCStone said in a note to clients. “Domestic U.S. demand is still good, but exports down the road look limited if not on the verge of being moved to South America.”

Traders also were closely monitoring U.S. weather forecasts as planting starts in southern growing areas.

A survey released by Farm Futures magazine forecast U.S. soy acreage at a record 87.25 million. Corn plantings were seen at 88.34 million acres.

— Mark Weinraub is a Reuters correspondent covering grain markets from Chicago. Additional reporting for Reuters by Michael Hogan in Hamburg and Colin Packham in Sydney.