U.S. live cattle futures fell on Tuesday, pulled down by anticipation for steady-to-lower cash cattle prices this week, analysts and traders said.

The Chicago Mercantile Exchange’s live cattle spot December contract also drifted below the 20- and 40-day moving averages of 126.67 and 126.48 cents, triggering liquidation by funds (all figures US$).

Funds also sold after most-actively traded February fell beneath the key 100-day moving average of 130.73 cents.

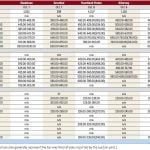

Spot December live cattle closed 0.875 cent per pound lower at 126.125 cents. February ended down 0.625 cent at 130.15 cents.

Read Also

U.S. grains: Soybeans tumble on doubts over U.S.-China trade progress

Chicago Board of Trade soybean futures plummeted on Friday as trade restrictions announced by China and escalating rhetoric from U.S. President Donald Trump cooled hopes of a resolution to a standoff between Washington and Beijing.

Futures weakened as investors awaited developments in the cash cattle sector, where no bids or asking prices were reported. Cash last week sold for $125-$126 per hundredweight (cwt), down $2-$3 from the week before.

Live cattle traders expect packers to pressure cash bids given their unprofitable margins, tepid wholesale beef demand and significantly more animals available than last week.

The list of cattle up for sale grew by about 40,500 head from a week ago, the result of packers not buying cattle in large numbers on the open market in recent weeks, a feedlot source said.

David Hales, president of Hales Cattle Trading Co., said packers recently purchased cattle through various "deals" that allowed them to stockpile inventories for at least the next two weeks.

The U.S. Department of Agriculture’s Tuesday morning wholesale price data showed choice beef at $195.13/cwt, down 19 cents from Monday, with select cuts up 89 cents at $175.48.

HedgersEdge.com put beef packer margins for Tuesday at a negative $67.55 per head, compared with a negative $82.95 on Monday and a negative $64.80 for Nov. 27.

CME January feeder cattle slipped on live cattle market selling, while weak corn prices underpinned the March contract.

January closed off 0.025 cent/lb. at 145.575 cents. March finished at 148.275 cents, up 0.05 cent.

December hogs rise

CME spot December hogs gained as buyers expect near-term cash hog price strength to bring the exchange’s lean hog index at 81.52 cents closer in line with the spot month.

Spot December hogs, which will expire on Dec. 14, settled at 84.45 cents/lb., up 0.525 cent.

But the average hog price on Tuesday morning in the most-watched Iowa/Minnesota hog market was $80.55/cwt, $3.95 lower than on Monday, USDA said.

"I’d prefer to see what USDA’s evening hog data shows because packer participation in the morning numbers is rather limited," a trader said.

Still, the prospect that packers may soon lower cash bids as their margins sink deeper into the red limited December’s advances.

Pork packer margins for Tuesday were at a negative $1.80 per head, compared with a negative 60 cents per head on Monday and a positive $7.55 for Nov. 27, according to HedgersEdge.com.

Deep-deferred trading months buckled under profit-taking pressure and spreading out of those contracts into nearby futures contracts, analysts and traders said.

Most-actively traded February closed down 0.15 cent/lb. at 85.525 cents and April closed 0.725 cent lower at 89.95 cents.

— Theopolis Waters writes for Reuters from Chicago.