Sweetening existing tax credits on big-ticket investments, and setting up a new Crown corporation to support Indigenous investors, are among the items expected to help encourage new value-added ag projects in Saskatchewan’s latest budget.

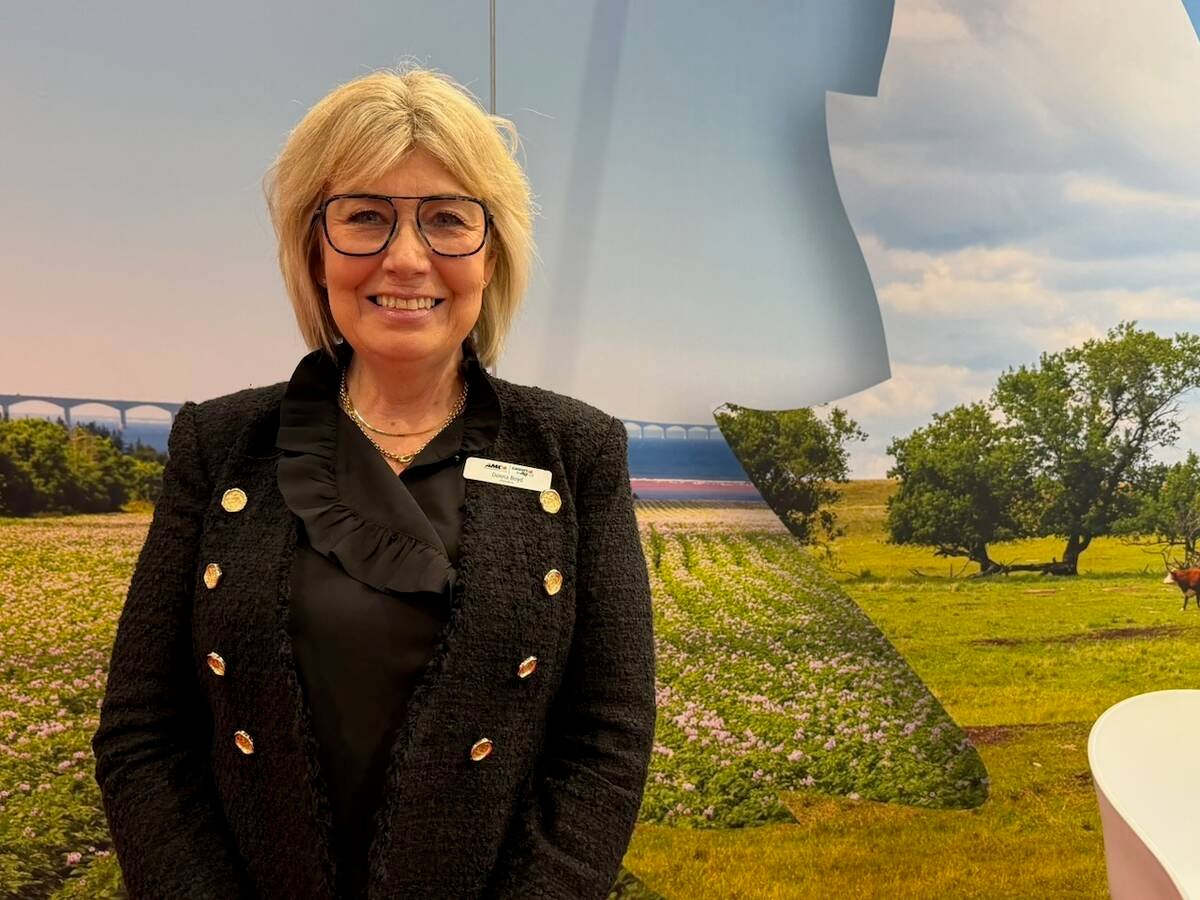

Provincial Finance Minister Donna Harpauer on Wednesday released her 2022-23 budget with $17.6 billion in expenditures on $17.2 billion in revenues, for an expected deficit of $463 million, well down from the province’s forecast deficit of $2.185 billion for 2021-22.

The province said its budgetary appropriations and expenses for the agriculture ministry come in at $462.4 million, up 19.5 per cent from 2021-22, on “strong 2022-23 crop insurance program and record agriculture research funding.”

Read Also

More Canadian companies at Agritechnica 2025

A record number of Canadian agriculture machinery and tech companies are at Agritechnica 2025, with exporters being more aggresive looking for new markets.

The 2022-23 budget’s broader agriculture-themed expenditures come in at $1.04 billion, up 18.3 per cent from the 2021-22 budget of $879.3 million, primarily due to “higher projected crop insurance indemnities as a result of higher crop prices, as well as higher reinsurance premiums.”

However, that estimate is well down from the province’s latest forecast for those 2021-22 ag-themed expenditures, at $3.19 billion, due mainly to last year’s drought-related crop insurance payouts and AgriRecovery program costs.

New line items relating to agriculture this year include $475,000 to set up a new Crown corporation, to be called the Saskatchewan Indigenous Investment Finance Corp.

The new Crown is expected to offer up to $75 million in loan guarantees on private-sector lending to Indigenous communities and organizations for investments into “natural resource and value-added agriculture projects,” the province said.

The province will also further backstop major value-added ag projects through “enhancement” of the Saskatchewan Value-added Agriculture Incentive (SVAI), a 15 per cent tax credit in place since 2018 on capital expenditures of at least $10 million toward newly constructed or expanded value-added ag facilities.

Retroactive to 2018, eligible projects will still get the 15 per cent rebate on the portion of a project’s expenditures up to $400 million, but could also get 30 per cent on the portion between $400 million and $600 million, and 40 per cent on the portion in excess of $600 million. The dollar value of the tax credit will be capped at $250 million.

Examples of qualifying projects include canola crush facilities, pea protein processors, oat milling operations, malt producing operations, and cannabis oil facilities, the province said.

The SVAI and other incentives are “key to Saskatchewan’s competitiveness, attracting private investment from global companies like BHP, Richardson International, Viterra, Ceres Global Ag, Cargill, Federated Co-operatives, AGT Foods, Paper Excellence and Red Leaf Pulp,” the province said Wednesday.

The province on Wednesday also noted that starting April 1 this year, certain “clarifications” will made to provincial sales tax (PST) related to farming and agriculture activities — for example, confirming a PST exemption for the “on-farm digging of dugouts.”

Revenues

On the taxation side of the ledger, the province announced Wednesday it will make “minor changes” to its education property tax (EPT) mill rates for this budget year, “asking residential (and) agricultural as well as commercial and resource property owners to pay slightly more EPT on average.”

For agricultural properties, that 2022 EPT mill rate will rise to 1.42 from 1.36, while residential property EPT mill rates will rise to 4.54 from 4.46.

Harpauer said Wednesday the province’s improved revenue forecast is based on increased revenue from taxes at $8.1 billion, up $850 million from 2021-22 — but also on non-renewable resource revenue at $2.9 billion, up by $1.6 billion from 2021-22.

That increased resource revenue, she said, is “largely due to higher potash and oil price forecasts, which is the result of stronger than expected global demand.”

While crude oil values have been on an upslope for months, they recently leaped higher following Russia’s invasion of Ukraine, as economic sanctions imposed by other countries limit Russia’s involvement in energy markets.

Potash prices have also climbed due to fresh sanctions limiting exports from both Russia and Belarus, the world’s No. 2 and 3 potash-producing countries behind Canada.

“It’s too soon to tell if oil prices will remain high for an extended period and what impact that could have on revenues,” Harpauer said, adding that “because resource prices are so volatile, our government has set a goal of reducing our reliance on resource revenues.” — Glacier FarmMedia Network