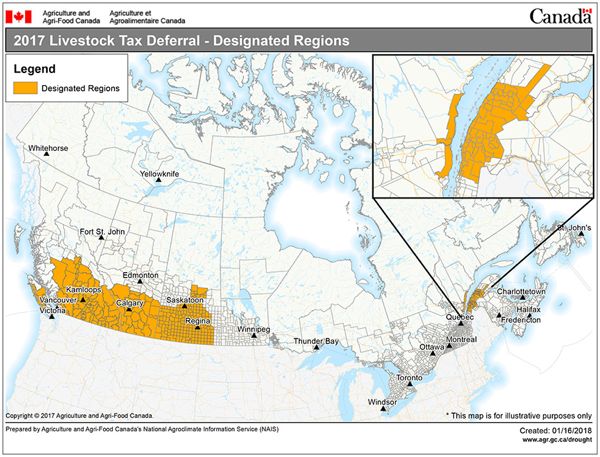

Livestock producers in several more parched municipalities in Saskatchewan and British Columbia will be able to defer income from sales of animals on their 2017 tax returns.

The federal government on Tuesday announced its final list of designated regions for 2017, including 20 more municipalities in Saskatchewan and seven in British Columbia.

The initial list, announced in early November, included much of southern Alberta, southern B.C., southwestern and south-central Saskatchewan and 57 municipalities along the St. Lawrence River in Quebec.

Read Also

Mexico agriculture secretary says still no date for restarting cattle exports to U.S.

Mexican Agriculture Minister Julio Berdegue said on Wednesday that Mexico and the United States have not yet set a date to resume Mexican cattle exports amid an outbreak of the flesh-eating screwworm parasite.

Also on the list, as of Tuesday, are the B.C. districts of Alberni-Clayoquot A, B, D and F, Comox Valley A and C (Puntledge-Black Creek) and Strathcona D (Oyster Bay-Buttle Lake).

The 20 Saskatchewan communities also now added to the list include the rural municipalities of Aberdeen, Antelope Park, Bayne, Blucher, Colonsay, Corman Park, Dundurn, Fish Creek, Grant, Harris, Hoodoo, Montrose, Mountain View, Oakdale, Perdue, Prairiedale, St. Louis, Vanscoy and Winslow and the city of Saskatoon.

The regions in question were deemed as suffering “significant forage shortages” due to low moisture levels last year, the federal government said Tuesday.

The tax deferral provisions allow livestock producers in prescribed regions to defer portions of their 2017 sale proceeds of breeding livestock, until the next tax year. Producers can request the tax deferral when filing their 2017 income tax returns.

The aim of the deferral is to help reduce the tax burden associated with the sale, as the cost of replacing the animals in 2018 is expected to at least partially offset the deferred income.

To be eligible for the deferral, a producer’s breeding herd must have been reduced by at least 15 per cent. If the breeding herd has been reduced by at least 15 per cent, but less than 30 per cent, then 30 per cent of income from net sales may be deferred.

Where the herd has been reduced by 30 per cent or more, however, 90 per cent of income from net sales can be deferred.

Proceeds from deferred sales are then included as income in the next tax year. If an area qualifies for a drought or excess moisture/flood designation in consecutive years, producers in that area can defer sales income to the first year in which the area isn’t designated.

The deferrals are requested if impact on a designated area is deemed “significant,” defined as forage yields of less than 50 per cent of the area’s long-term average.

“This tax deferral will help producers manage the impacts of the adverse weather, while focussing on rebuilding their herds in the coming year,” Agriculture Minister Lawrence MacAulay said in a release. — AGCanada.com Network