Fertilizer producer Mosaic beat Wall Street expectations for first-quarter profit on Tuesday, driven by strength in its South America business.

Shares of the company rose 1.8 per cent after the bell.

The results come as the agrichemical industry braces for potential fallout from U.S. President Donald Trump’s sweeping tariffs on most imports, which are expected to lower demand and curb farmers’ spending.

The company also raised its production forecast for potash for the current year, as it expects that improved demand will push prices higher.

Read Also

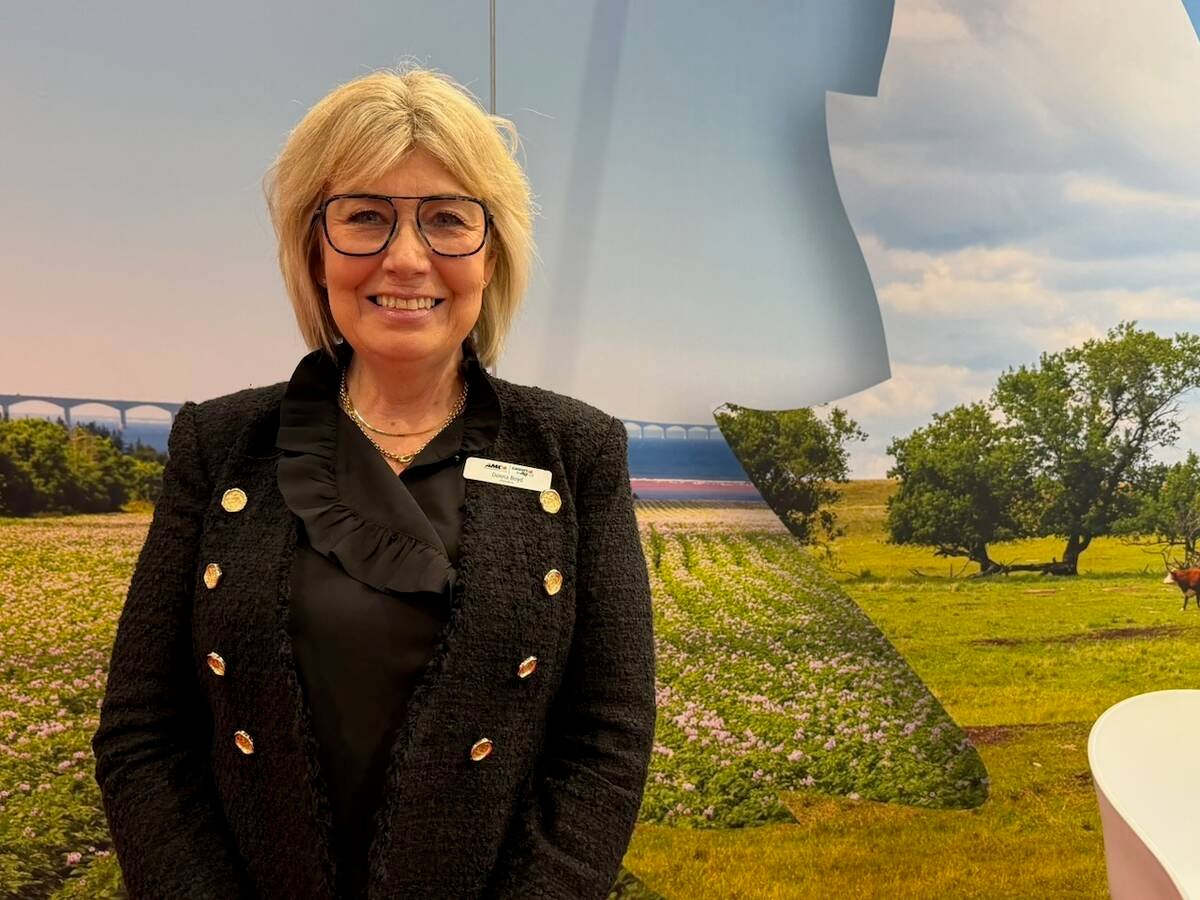

More Canadian companies at Agritechnica 2025

A record number of Canadian agriculture machinery and tech companies are at Agritechnica 2025, with exporters being more aggresive looking for new markets.

It now expects potash production to range between 9 million tonnes and 9.4 million tonnes in 2025, compared to its previous projection of 8.7 million tonnes to 9.1 million tonnes.

Production cost improvements helped boost adjusted core profit in Mosaic’s South America fertilizer segment to $122 million (C$168 million) in the first quarter, up from $83 million a year earlier.

The segment also benefited from a modest increase in sales volumes, reporting net sales of $934 million (C$1.29 billion) in the quarter, compared to $886 million the previous year.

The Tampa, Florida-based company reported adjusted earnings of 49 cents per share for the quarter ended March 31, compared with analysts’ average estimate of 45 cents per share, according to data compiled by LSEG.

—Reporting by Vallari Srivastava in Bengaluru