CNS Canada — ICE Futures Canada canola contracts have trended lower for the past month and still have some more room to the downside heading into the New Year, according to an analyst.

“I think we’ll go lower,” said Errol Anderson, of ProMarket Communications in Calgary, citing a number of bearish factors.

Activity in the Chicago Board of Trade soy complex remains a major driver for canola. If improving weather in Argentina continues to cause weather premiums to leak out of the Chicago soybean futures, canola will also continue to decline, said Anderson.

Read Also

China to buy 12 million metric tons of soybeans this season, Bessent says

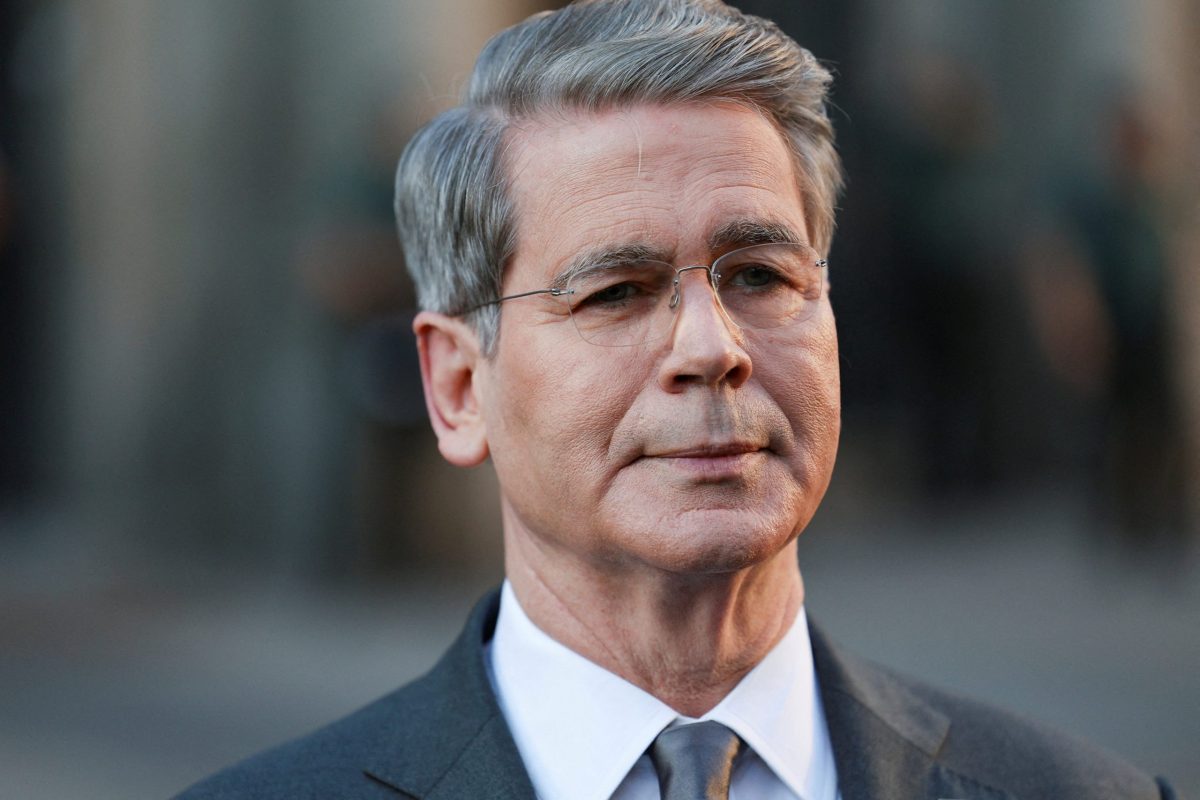

U.S. Treasury Secretary Scott Bessent said on Thursday that China has agreed to buy 12 million metric tons of American soybeans during the current season through January and has committed to buying 25 million tons annually for the next three years as part of a larger trade agreement with Beijing.

As a result, he saw “no real reason for basis levels to be that aggressive.”

The larger-than-expected 21.3 million-tonne Canadian canola crop estimated by Statistics Canada on Dec. 6 also remains “a burr in the saddle” for canola, as the bigger production effectively doubled the anticipated carryout, according to Anderson.

Bearish chart signals, as prices moved below support levels during the week, could see both the March contract and the new-crop November futures break below $500 per tonne.

Recent duties imposed by India on palm oil have weighed on vegetable oil markets in general, including canola. In addition, Anderson thought the Canadian dollar could strengthen in the near future.

However, with all of that bearish news in the background, there is always the possibility of some kind of spark triggering an eventual bounce off of the lows. “The key is, what recovery will we have in the New Year?” Anderson said.

— Phil Franz-Warkentin writes for Commodity News Service Canada, a Glacier FarmMedia company specializing in grain and commodity market reporting.