London | Reuters –– Commodity miner and trader Glencore has agreed to sell 40 per cent of its agricultural unit to Canada’s state pension fund for US$2.5 billion, the company’s latest step to cut debt and soothe investor concerns about the impact of weak commodity prices.

The sale values the agricultural unit as a whole at close to the initially expected $10 billion, including $600 million in debt and $2.5 billion in inventories, and comes after Glencore said last month it was stepping up its debt reduction plan by unloading more assets (all figures US$).

Read Also

China to buy 12 million metric tons of soybeans this season, Bessent says

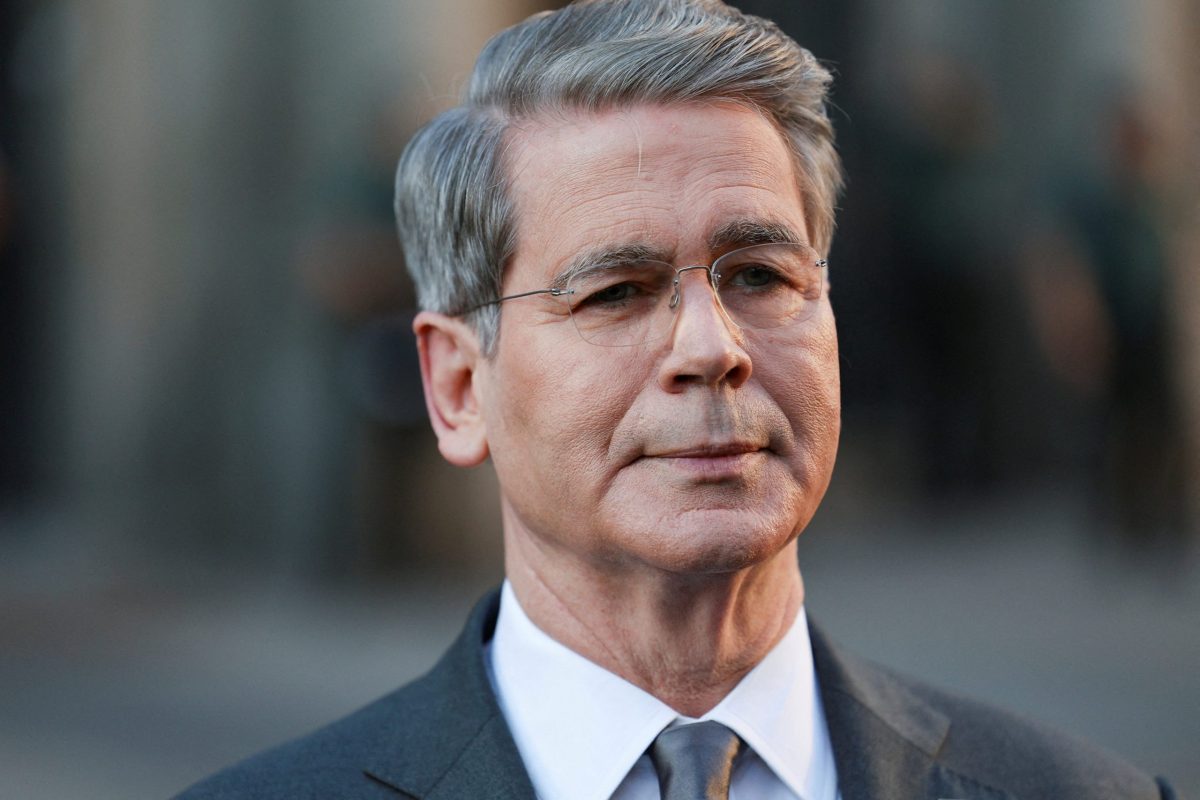

U.S. Treasury Secretary Scott Bessent said on Thursday that China has agreed to buy 12 million metric tons of American soybeans during the current season through January and has committed to buying 25 million tons annually for the next three years as part of a larger trade agreement with Beijing.

The group said it aimed to cut net debt to between $17 billion and $18 billion by the end of 2016, $1 billion more than previously planned and down from a peak of $30 billion last year.

The purchase is by the pension fund’s investment unit, the Canada Pension Plan Investment Board (CPPIB), which seeks long-term low-risk investments.

“Glencore Agri complements our existing portfolio of agriculture assets, bringing global exposure, scale and diversification,” CPPIB’s global head of private investments, Mark Jenkins, said in a statement

Glencore’s stock had collapsed to below 70 pence (C$1.30) at the end of last year, a fraction of its peak of 556 pence following its 2011 flotation, due to investor worries over its heavy debts coupled with slumping copper and coal prices.

Investment grade

The stock has, however, doubled in value since then, after the company took steps to cut debt and protect its investment- grade credit rating, by raising money via a share issue, reducing inventories, suspending dividends and selling assets.

“Management continue to be proactive and delivering on the stated objective of reducing debt,” said Charl Malan, portfolio manager at investor and Glencore shareholder Van Eck Associates.

Malan said that he expects Glencore to continue to drive debt lower via asset sales, metal streaming deals and improved operating efficiencies.

Glencore expects the agriculture deal to complete in the second half of 2016.

Major Canadian grain handler Viterra is part of Glencore’s ag business, includes more than 200 storage facilities globally, 31 processing facilities and 23 ports, allowing Glencore to trade grains, oilseeds, rice, sugar and cotton.

It generated core earnings of $524 million in 2015 and had gross assets of more than $10 billion.

Under the agreement, Glencore has the right to sell up to a further 20 per cent stake. Glencore and CPPIB may also call for an initial public offering of Glencore Agri after eight years from the date of completion, the companies said.

Glencore Agri would be run by current chief Chris Mahoney and a board to which CPPIB and Glencore would each appoint two directors.

Shares of Glencore rose as much as 2.2 per cent on the announcement of the disposal, before retreating to trade 4.5 per cent down by 12:36 GMT. The FTSE was up 0.6 per cent.

“The more assets Glencore disposes of, the more shareholders will begin to weigh up the benefits to the balance sheet versus the negatives of lost future revenue,” said Jasper Lawler, market analyst at CMC Markets.

Barclays, Citi and Credit Suisse were Glencore’s joint financial advisers and Linklaters LLP provided legal advice. Deutsche Bank was sole financial advisor to CPPIB.

— Dmitry Zhdannikov is a Reuters editor based in London, England. Additional reporting Reuters by Sarah McFarlane and Alistair Smout in London and Noor Zainab Hussain and Vidya L. Nathan in Bangalore.