CNS Canada — Bullish weather propped up Chicago Board of Trade (CBOT) corn and soybean futures, spurring spec buying on the week — but it’s likely not enough to break the commodities’ ranges, one U.S. analyst says.

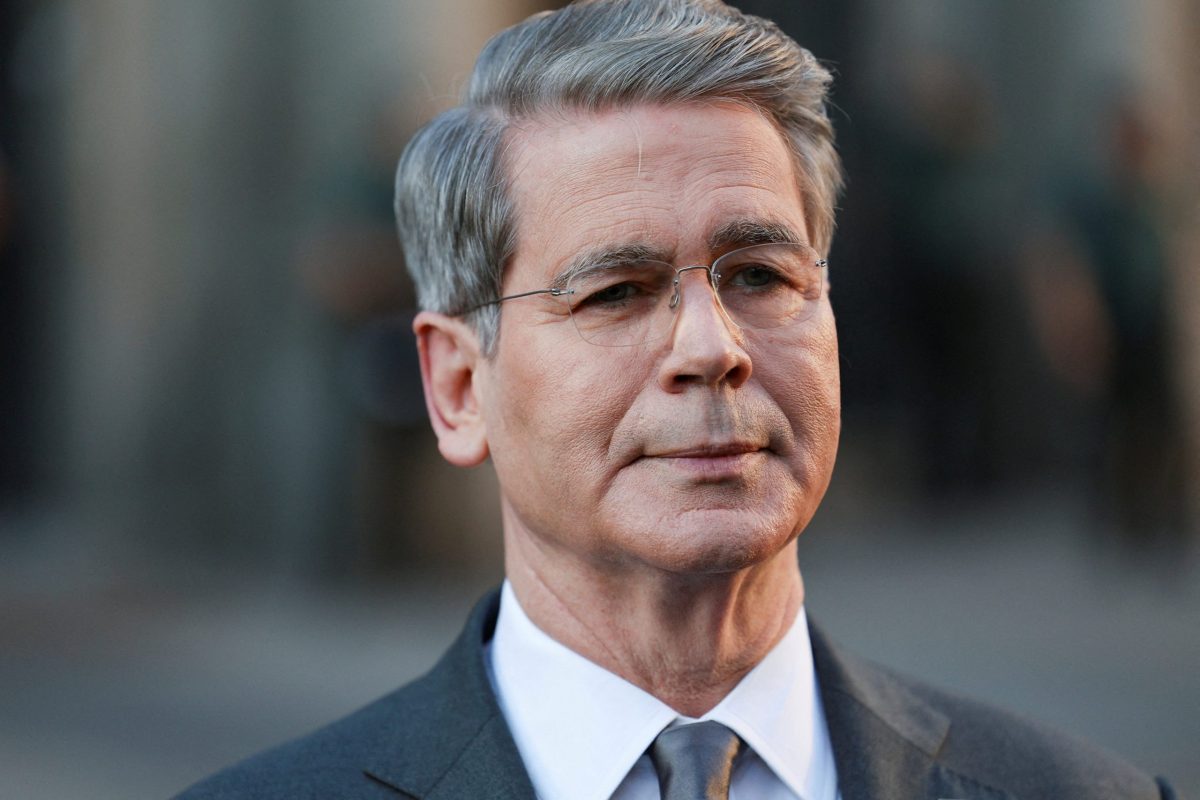

“Lately here, of course it’s been weather with all the rain last week and over the weekend. The snow has got everybody a little nervous,” said Brian Rydlund, market analyst at CHS Hedging.

Adverse weather in key U.S. growing regions caused speculative buying in CBOT markets, he added.

Read Also

China to buy 12 million metric tons of soybeans this season, Bessent says

U.S. Treasury Secretary Scott Bessent said on Thursday that China has agreed to buy 12 million metric tons of American soybeans during the current season through January and has committed to buying 25 million tons annually for the next three years as part of a larger trade agreement with Beijing.

“When the managed money crowd gets nervous they usually look to rally,” he said.

Since last week, soybean futures have gained close to 19 cents per bushel in the July contract, closing at $9.7525 while corn advanced about eight cents, closing at $3.7475 (all figures US$).

Those gains didn’t cause charts to break into new territory, Rydlund said, adding that the world is flush with supplies, which keeps a lid on rallies.

“It doesn’t look like they’re making any less down in South America,” he said. “Their crops continue to get bigger in people’s eyes — they’re not done with it yet.”

He expects both corn and soybeans to stay relatively rangebound in the near term, unless a sustained threat to U.S. crops emerges.

— Jade Markus writes for Commodity News Service Canada, a Winnipeg company specializing in grain and commodity market reporting.