Sao Paulo | Reuters — JBS, the world’s largest meatpacker, said cattle remain scarce and expensive in the U.S., dampening the outlook of its beef business in the country where the company derives most of its sales.

Why it matters: The Canadian beef sector is highly integrated with the U.S. industry

While the operating environment will remain challenging this year, management sees room for margins at the company’s U.S. beef division to improve by one to 1.5 percentage points in the next few quarters.

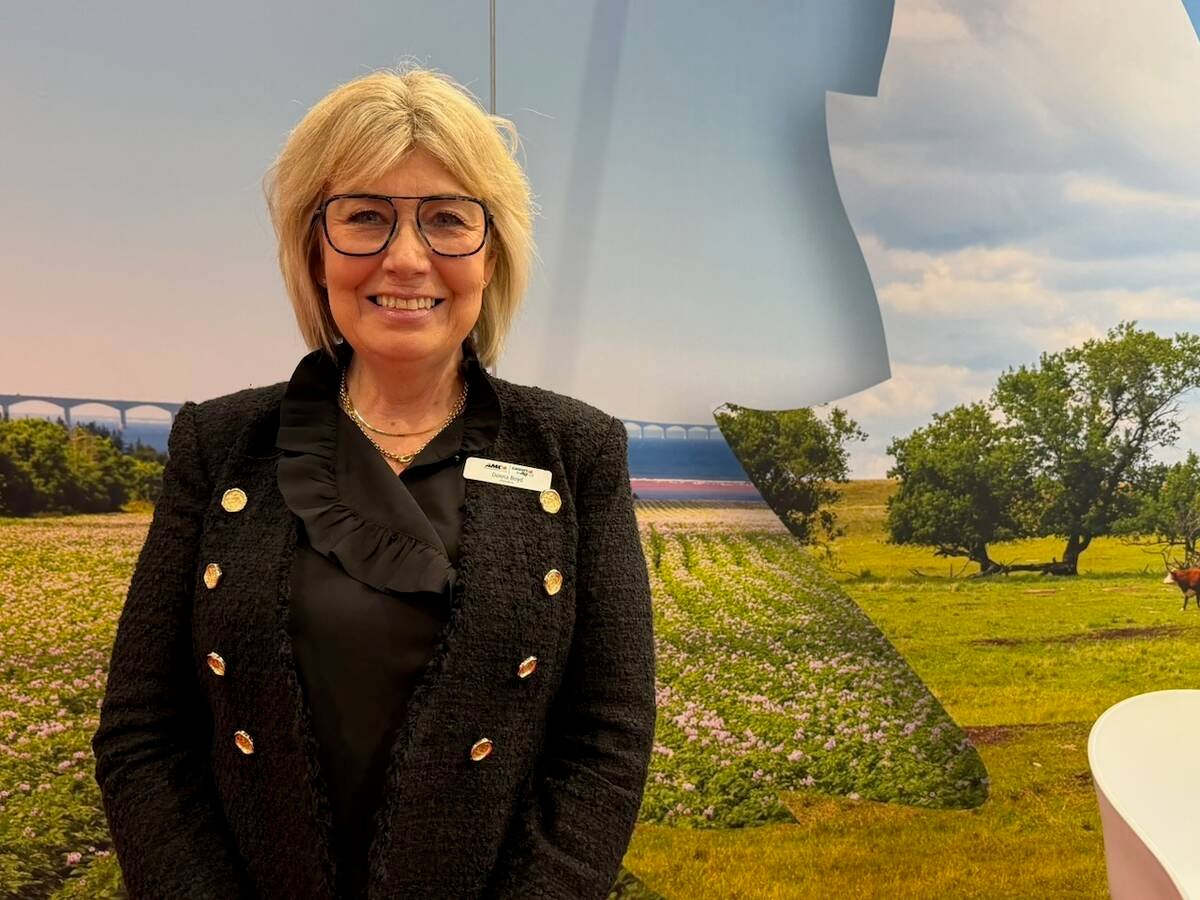

Read Also

More Canadian companies at Agritechnica 2025

A record number of Canadian agriculture machinery and tech companies are at Agritechnica 2025, with exporters being more aggresive looking for new markets.

Speaking with analysts to discuss first-quarter results, managers answered questions regarding the outlook for global operations, especially in the U.S., Brazil and Australia.

The company said it sees strong demand for proteins across all regions and expects to continue expanding, including through acquisitions.

Chief Financial Officer Guilherme Cavalcanti, who emphasized JBS’ ability to reduce debt through cash generation in 2024, said the company could pay higher dividends this year if no “opportunistic” acquisitions arise.

Asked about U.S. tariffs against countries such as Mexico and Canada, management said it was difficult to assess their impact because variables keep changing.

Director-at-large Wesley Mendonça Batista Filho said a better assessment could be made after April 2, noting trade measures already announced by the Trump administration did not affect JBS’ first-quarter performance.

Regarding plans for a primary share listing in New York, CEO Gilberto Tomazoni said he expects the process to be concluded by the end of the year. He cautioned, however, JBS has no control over approval of the plan, which depends on the U.S. Securities and Exchange Commission and shareholders to proceed.