Higher interest rates don’t seem to be affecting the ratio between land values and land rental costs — at least not yet.

Farm Credit Canada’s latest analysis of farmland rental prices shows they’re roughly maintaining their traditional linkage, says J.P Gervais, the organization’s chief economist.

WHY IT MATTERS: Understanding the rent-to-price ratio for farmland can help farmers decide whether renting land is a viable option.

Read Also

Bean research breeds community giving

University of Guelph dry bean researcher Dr. Mohsen Yoosefzadeh Najafabadi champions sustainability by donating surplus breeding program beans to support food security and community art initiatives.

“We were curious to see whether that would bring up land rental rates faster,” says Gervais. “Not yet, it appears. Land rental rates seem to be moving roughly at the same speed as land values.”

However, there could be a lag in the effect that interest rates are having on the market.

“I think we’re going to find out,” says Gervais, but he points out that it could take the better part of this year before it becomes apparent.

Incidentally, Gervais says that while financial markets predict a rate decrease as soon as October, he sees that as overly optimistic.

“We’ve had a pretty strong labour market, which is sustaining consumer spending. Yes, inflation is coming down, but the economy is still moving forward right now, and a lot of us thought that we would have seen a slowdown already, but we haven’t.

“The economy is more resilient than everybody expected. I think it’s a bit premature to say that we’re going to get a rate cut as soon as October. I’m starting to doubt even that’s going to happen in December.”

But Gervais says interest rates are just part of a collection of market pressures affecting rental rates. “There are several economic conditions that impact the cost of renting land in Canada. Land values, the availability of land and its quality can all drive rental prices.”

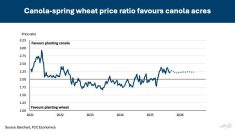

In mid-April, FCC released its annual analysis of the rent-to-price ratio for cultivated farmland in Canada. Across the country, the rent-to-price ratio in 2022 was 2.55 per cent, compared to 2.5 per cent in 2021. In Saskatchewan and Alberta, there were slight year-over-year increases. The ratio increased to 3.1 per cent and 2.6 per cent respectively, while all other provinces saw decreases.

FCC calculates the ratio by dividing the rental cost per acre by the land value per acre. A ratio trending lower suggests that cash rental rates are appreciating at a slower pace than land values.

Around 40 per cent of Canadian farmland is rented. Typically, renting is less expensive than purchasing, and the lower the ratio, the better the renting option becomes.

For young farmers and new entrants, renting is seen as a viable option to free up capital that would otherwise be tied up in purchasing and instead can be put towards financing options for other needs like machinery or inputs.

Another important consideration when deciding whether to buy or rent is understanding the relationship between rental rates and cropland revenues. Rental rates as a proportion of crop gross revenues have declined since 2020, but crop input costs have increased significantly, putting pressure on profitability.

“We know that we have lower prices than we had last year so margins are likely to be lower,” says Gervais, noting input costs increased significantly last year but have come down a bit this year.

“I don’t think that the decline is that significant since, if you look at fertilizer prices, they’ve been trending down, but some of it has already been purchased. The bottom line is, those margins are tighter.”

FCC began tracking the ratio three years ago to help farmers navigate these waters. But Gervais warns against making snap decisions based on only a small part of the picture. The decision to purchase or rent land can have long-term implications.

“Do you have your strategic plan in mind? Where do you want to take your farm five years from now? What are the targets you have in mind?”

He says farmers sometimes look at the price differential and interest rates and pull the trigger if their costs per acre can be reduced a little. While that’s important, it shouldn’t be the determining factor.

Gervais recommends farmers stick to their five-year plan and only make decisions if they fit within that plan.

“If you start out looking beyond year one and have that five-year perspective, I think that opens up a bit of a different discussion and maybe different decisions, even facing the same set of numbers.

“Deciding whether to buy or rent is a strategic decision unique to each producer. There is a lot to consider, including interest rates, yields, commodity prices and input costs. Open communication and collaboration between landowners and renters creates a quality, long-term relationship. Matched with a risk management plan and business strategy, producers have the building blocks for success.”