A diverse crop of economic pressures are challenging the agriculture sector heading into 2025.

Cam Mock, senior relationship manager at Farm Credit Canada, highighted some of the challenges Ontario farmers will face this year in a macroeconomic update and crop sector outlook at the annual Grey County Soil and Crop Winter Meeting in Durham last month.

Mock noted that despite good yields, farmers may face problems getting their crops to market as the threat of tariffs looms. But this is just one of the concerns he believes could affect profits in 2025.

Read Also

Extreme variability marks Ontario’s 2025 corn crop

The yield potential of Ontario’s 2025 corn crop was lost in some areas due to extreme dry conditions.

“Inflation in Canada, as of about October 2024, was sitting around two per cent which was essentially the Bank of Canada’s target,” he said. “So the mission of raising short-term interest rates and interest rates in general was to curb the inflation that we saw coming out of the pandemic that had been a bit of a runaway train.”

He added that current rates are signalling there may be further cuts, which would trigger positive economic growth in the wake of years of stagnation. He expected there may be a rise in GDP in 2025, but said overall data was showing signs the economy was slowing down.

A recent business outlook survey conducted by the Bank of Canada indicated that business sentiment is low, and Mock said the results were indicative of either a recession or slow economic growth.

“Businesses were middle of the road at best as to how they were feeling about things. The Canadian consumer is under pressure,” he said, adding that more than 14 per cent of household disposable income in Canada went to serving debt in 2024. “That’s pretty darn close to the highest that it’s ever been.”

“About 60 per cent of GDP is made up of consumer spending, so if consumers are pressed, and they’re not spending and not disposing of money as they have been, it’s pretty material to the economy overall,” he said.

A low Canadian dollar would traditionally make Canadian goods more appealing to the U.S. market, but President Trump’s tariff threats have Mock believing this could dampen interest from south of the border.

“That tariff thing keeps creeping in and if that were to come into place, it would make exports a lot less desirable,” he said.

The value of the dollar will also have an effect on commodity prices heading into 2025.

Vanessa Scott, manager of business development at FCC, said Canadian corn prices in particular are going to be influenced by exchange rates and U.S. supplies.

“Canadian prices, if they do not trend higher, will likely be the result of a weak Canadian dollar,” she said, adding that FCC is keeping an eye on U.S. domestic use and exports which will change going forward. “The new Trump administration is certainly a big factor, and we’re all unsure on the tariff front as well as biofuels. He could be unfavourable towards biofuels, which would also impact core demand.”

Scott noted soybeans may be more significantly impacted by tariffs. Further to this, she noted that the team at FCC is watching China, which has been shifting its supply chains.

“They’ve been moving more to South American supply, so that is an impact here in North America,” she said.

Turning to diesel and fertilizer prices, Scott said other global economic pressures may affect prices and supply in Canada. She said the war in Ukraine has curtailed production. Additionally, the war between Israel and Hamas may have an impact on Middle Eastern production going forward.

“Israel accounts for eight per cent of global phosphate exports and six per cent of potash. However, Israel is specifically involved in specialty fertilizers so if the war escalates to other regions, fertilizer prices, and most notably nitrogen ,would be impacted,” she said.

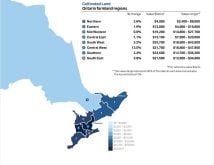

Farmland Prices Continue Upward Trend

The desire for farmland remains steady, despite a slight drop following the end of the pandemic. The latest farmland values in Ontario have risen by more than 10 per cent according to the latest data.

“That really speaks to, that even in uncertain times and high borrowing costs, land values just charge ahead,” said Mock, adding that economists do not foresee this trend changing in 2025.

He added that fewer farms are being “sold over the fence” presenting a better buyer’s market.

“There’s not a lot of land for sale and not a lot of room for it to grow in value,” adding there continues to be a rise in crop sharing arrangements which can offer some tax benefits for both parties.

Overall, Mock concluded that the current economy will continue to present challenges and he recommended farmers stay aware of changes to the markets to mitigate risk.