U.S. livestock: Cattle futures mixed Tuesday

Speculators bail out of canola long positions

Tariff uncertainty tied to liquidation

Canadian spring wheat bids strengthen

Rising futures, weak loonie provide support

Canadian canola crush hits record in 2024, but soybeans down

Canola crush up 8.1 per cent, soybeans down 11.6 per cent

Ontario farmers to plant more corn, less soybeans in 2025: StatCan

Farmers also seeding more peas, corn and oats

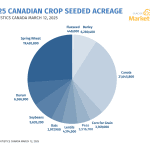

Canada to seed more wheat, less canola in 2025: StatCan

Farmers also seeding more peas, corn and oats

New Chinese tariffs “devastating” to Canadian ag sector

Ag groups decry latest trade action

New initiative to promote farmer mental health launched

Collaborative solutions wanted

ICE canola weekly outlook: Politics in the forefront

Trade war weighs on canola prices

Spring flood risk low to moderate in Manitoba: Report

Outlook depends on spring weather